Premium Underpricing Bane of Insurance Growth in Nigeria – Experts

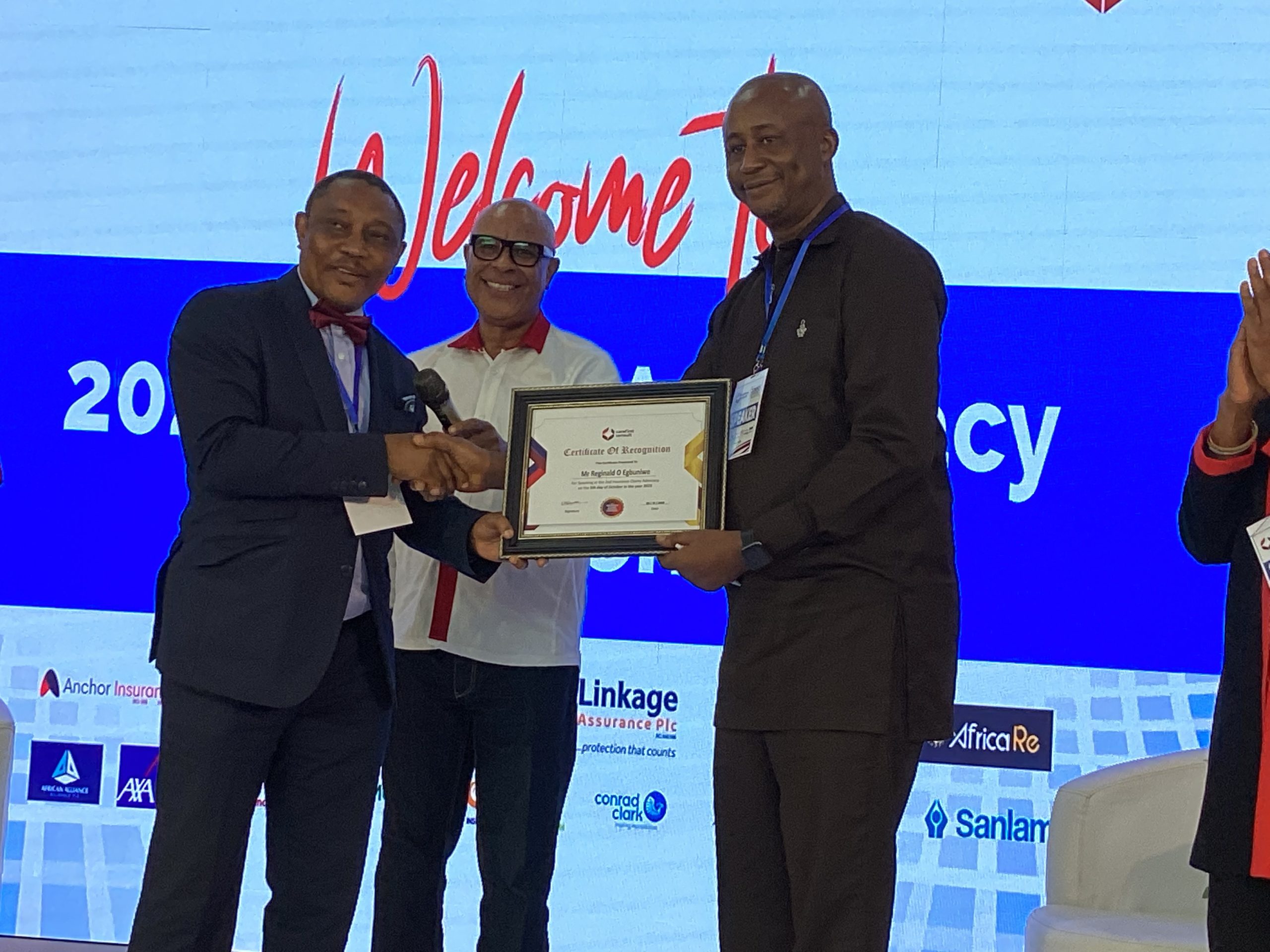

L-R: Mr Edwin Igbiti, President, Chartered Insurance Institute of Nigeria (CIIN); Mr. Richard Ogunmodede, Financial/Fintech Expert and insurance consumer; Mrs Rashidat Adebisi, Chief Client Officer, AXA Mansard; Chairman of the confidence, Ms. Prisca Soares; Mr Gus Wiggle, Founder/Principal Consultant and Mr. Reginald Egbuniwe, Managing Director, Grand Metropolitan Associates during the 2023 Claims Advocacy Conference on Thursday, October 5, 2023.

Experts have identified premium underpricing and lack of collaboration among the players as the bane of insurance growth in Nigeria, noting that the premium charged in Nigeria is too meager compared to what is applicable in other parts of the world.

While calling on the insurance operators and regulators to do something about this, they emphasized the need for collaboration among industry operators.

Speaking at this year’s Claim Advocacy Conference organised by Carefirst Consult with the theme “Understanding Insurance Beyond Claims Payment,” the Chairperson of the occasion, Ms Prisca Soares, the former Secretary General of the African Insurance Organisation (AIO) said the “premium charged in Nigeria is too meager compared to what is applicable in other parts of the world and something needs to be done about that.”

“A situation where some company gives so much as discounts to their clients is one thing that is not allowing the industry to grow the way it should. This is a suicidal tendency which we have to do something about. We really do need to cooperate in this market so that there would be sustainability because if insurance goes down, everything else does,” she appealed.

L-R:Mr. Richard Ogunmodede, Mrs Rashidat Adebisi, Mr. Edwin Igbiti, Ms. Prisca Soares, Mr. Gus Wiggle, and Mr. Reginald Egbuniwe

Those who spoke at the conference include Mr. Reginald Egbuniwe, Managing Director, Grand Metropolitan Associates; Mrs Rashidat Adebisi, Chief Client Officer, AXA Mansard and Mr. Richard Ogunmodede, Financial/Fintech Expert and insurance consumer.

In his presentation titled ‘What Insurers do When Claims are Reported,’ Mr. Reginald Egbuniwe listed the complexities of handling some claims which he said is very important for consumers to understand.

Highlighting the differences between simple and complex claims, Egbuniwe said “If you have a simple claim, the insurance company has to be notified. Once a claim is reported, the insurance company has to receive it and make sure that whoever is reporting the claim has a policy with them. The claim has to be authenticated and when that is ascertained, a number will be allocated and a claim form will be sent. This doesn’t take long. Depending on what is in the policy, it is expected that a claim should be reported in seven days, 14 days, or whatever.

CIIN President, Mr Edwin Igbiti presenting appreciation certificate to Mrs. Prisca Soares at the 2023 Claims Advocacy Conference in Lagos.

He advocated for the employment of Loss Adjusters into the insurance system “so that they can monitor the process of our work in real-time.”

Speaking on the topic ‘Why documentation is critical for claims payments, Rashidat highlighted the importance of accuracy and timelines as critical to claim administration, which she said assists the insurers in taking decisions on claims.

According to her, Insurance needs to have documentation, it is actually required by law. As a policyholder when an incident occurs and you are making claims, it is expected that you provide concrete evidence before you can be paid.

“There is a need for documentation because sometimes insurance companies may want to pay but if you don’t have the necessary document required by law, it becomes a problem.

”Customers should always ensure that forms sent to them are properly filled and returned to their insurance companies ahead not necessary when there are claims to make.

“Some people even tender fake receipts and you have to validate it. There is a need to investigate because in this part of the world, people can be funny,” she added.

In his presentation on ‘Claim is the Best Teacher in Insurance/Life After Claims’ Mr. Richard Ogunmodede, highlighted the industry’s problems and the negative effect on its growth.

He said “The problem is the leading indicator and the impact is a liking indication. If you want to manage something it is better to focus on the leading indicator because you cannot control or influence the liking indicator.

“Insurance has been mispriced in Nigeria. There is a mismatch in the system. In the industry, you have bad insurers and bad consumers and so you have big systemic problems.

“Insurers talk all the talk but they never do the work. They just compete based on agreed premium and at a zero rate and the consumer assumes there are implicit guarantee that even when the insurer goes down, they will still get their indemnity so they don’t care about the rate too.

He said the growth rate of the Nigerian insurance industry and its contribution to the nation’s GDP is very small and called on the operators to do something, especially on the issue of rate.

While narrating his experience with the Nigerian insurance industry, he said the process of getting claims paid is too cumbersome and called for a better way of doing it.

Earlier in his welcome address, the Founder/Principal Consultant, Carefirst Consult Limited, Mr. Gus Wiggle, highlighted the objective of the conference which he said is “to ease discussions about claims amongst insurance stakeholders thereby filling the void in the insurance ecosystem and adding to the value chain of insurance. We are purposed to be the bridge between the consumers and the insurance providers.

“Claim will remain the anchor of insurance business and will remain on the front burner while communication will become the point of impact of expressing consumers’ impressions…”

He said paying claims is part of the insurance proposition, adding that a lot needs to be done to boost communication with customers on claims issues.

“Customers desired to be informed regularly in a manner that keeps them abreast of the industry activities as this is pivotal to insurance penetration. Insurance can achieve this by exploiting social media. No insurance company currently does this consistently especially using the social media platforms,” Wiggle said.