Insurers To Drive Third Party Motor Insurance With ‘Small Premium, Big Coverage’ Campaign

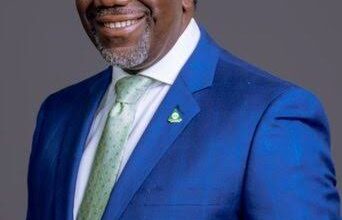

L-R: Davis Iyasere, Head, Corporate Affairs/Human Resources, Nigerian Insurers Association (NIA); Managing Director/CEO, Sunu Assurance Plc, Mr. Samuel Samuel Ogbodu; Director General, Nigerian Insurers Association (NIA), Mrs Yetunde Ilori; Managing Director/CEO, Stanbic IBTC Insurance, Mr Mr. Akinjide Orimolade; Deputy Director, Corporate Communications/Market Development, National Insurance Commission (NAICOM) and the Managing Director/CEO, Guinea Insurance Pllc, Mr Ademola Abidogun all members of the Publicity Sub-Committee of the Insurers Committee in a group photograph shortly after the press conference to announce the flag-off of the ‘Small Premium, Big Coverage’ campaign on new premium rates for motor insurances today in Lagos.

Poised to shed more light on the new Third Party Motor Insurance rates as well as generally improve insurance uptake among Nigerians, the Nigerian Insurance industry has unveiled a campaign called “Small Premium, Big Coverage.”

Speaking at a media parley with insurance journalists in Lagos today, the Chairman of the Publicity Sub-Committee, of the Insurers Committee, Mr. Akinjide Orimolade, said the campaign which will last for three months will commence on Monday, July 24, on Radio, Television, Newspapers and social media platforms.

“This is a pan Nigerian campaign covering social media, print, radio jingles and television commercials some of which you will be seeing now,” he said.

He said for the campaign to get across to the target audience in the six geo-political zones of Nigeria, the message has been simplified in various local languages including Igbo, Yoruba, Hausa and pidgin.

The campaign is in line with the National Insurance Commission (NAICOM) Circular of December 2022 which approved new premium rates and the Total Third Party Damage (TTPD) compensation limit.

According to the circular which took effect January 1, 2023, the third party motor insurance new premium rate is now N15,000 while the claims limit is N3 million.

“Own goods third party cover attracted N20,000 premium with N5 million compensation.

“Staff bus attracted N20,000 premium with N3 million compensation.

“Commercial (trucks, general cartage) attracted N100,000 premium with N5 million compensation.

“Special types attracted N20,000 premium with N3 million compensation.

“Tricycle attracted N5,000 with N2 million compensation.

“Motor cycle attracted N3,000 with N1m compensation.

While commending the journalists for their support thus far, Mr. Orimolade who is also the Managing Director/Chief Executive Officer, Stanbic IBTC Insurance, appealed to journalists for more support.

“We need your support in this journey and do hope that as partners in progress, you will give this campaign the publicity it deserves.

Over the three months period that this campaign is scheduled to last, we expect massive publicity from you and do hope you will give it your best.

He called on Nigerians to embrace in order to take advantage of the numerous values it offers.