FBN General Insurance unveils three new retail products

L-R: Modupe Akinwande, Head, Enterprise Risk Management; Elizabeth Agugoh, Head, Marketing and Corporate Communications; Bode Opadokun, Managing Director; Tunde Mimiko, Executive Director; Pauline Ogebe, Head, Legal; Dunni Oladokun, Head, Retail and Jacqueline Agweh, Head, Claims all of FBN General Insurance at a press conference held today (October 4, 2018) in Lagos.

FBN General Insurance, one of the preferred General Insurance firms in Nigeria, has unveiled three new retail products to further consolidate its strength in the retail segment of the market while meeting the needs of the insuring publics as well as deepening insurance penetration.

The three new products, Auto Flexi Insurance, Flexi Home Insurance and Flexi Guard Insurance, according to the management of the company, have been approved by the National Insurance Commission (NAICOM).

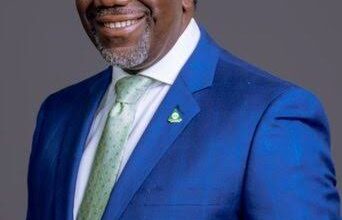

Speaking on the benefits and values of the products at a press conference today in Lagos, the Managing Director and Chief Executive Officer of the Company, Bode Opadokun, said the new products are simple, affordable and flexible.

He said Auto Flexi is designed to meet customers’ specific needs. “Auto Flexi came out of the needs that customers have in terms of request. We have seen several instances where some of our customers both existing even prospective having issue of pricing. Pricing in terms of affordability and ability to pay the premium that is applicable based on the value of some of the vehicles.”

The products, according to him, is designed to cover the insured against specific, pre-agreed losses; legal liability to pay compensation to a third party in the event of an accident that cause property damage or bodily injury to the third party.

He said the policy also covers the insured in the event of damages due to an accident and fire damage up to the agreed value insured.

The policy is divided into three variants of Flexi Gold, Flexi Silver and Flexi Bronze with agreed insured value up to N1 million for a premium of N40,000; N500,000, for a premium of N25,000 and N100,000 for a premium of N15,000 respectively.

The product also covers third party property damage up to N2 million in all the three variants.

Speaking also on Flexi Home policy, Opadokun said the product is a home content insurance policy, designed to ensure adequate cover for customers’ treasured home including the contents.

“The FBN General Insurance Flexi Home is a home content insurance cover that compensates the insured in the event of loss or damage to property belonging to the insured as a result of fire and/or allied perils,” the MD added.

The products is available in four variants, namely: Flexi Home Bronze, Flexi Home Silver, Flexi Home Gold and Flexi Home Platinum for agreed insured value of N1 million, N2 million, N3 million and N5 million for an annual premium of N7,500, N15,000, N20,000 and N30,000 respectively.

On the Flexi Guard, the MD said “Flexi Guard is a protection policy that pays compensation to the insured in the event of injuries, disability or death caused solely by external and visible event.”

The policy is available in three variants of Flexi Guard Silver, Flexi Guard Gold and Flexi Guard Platinum. The policy covers among other things bodily injury, death or permanent disability to the tune of N500,000 for a premium of N1,500, N1 million for a premium of N3,000 and N2 million for a premium of N5,000.

This insurance product, according to the MD, provides cover for other eventualities such as any form of accidents; strike, riot and civil commotion; Dog bite, wild animal attack as well as motorcycling either as a rider or as a passenger.

On what should be expected from FBN General as the year winds down, the MD said, the firm will continue in its profitability trajectory, having recovered from a loss position to a profit position since 2016, adding that the company will continue to sustain a robust top line and bottom line while maintaining a steady growth profile in her profitability margin and return on investments.

On his achievement as the MD/CEO of the company in the past two years, he said he has been able to take the company from a loss position to profitability even as he promised to sustain the momentum going forward.

L-R: Tunde Mimiko, Executive Director, (left) and Bode Opadokun, Managing Director, both of FBN General Insurance.