Examining Jaiz Bank’s 10 Years of Sustainable Growth in Islamic Banking

Jaiz Bank Plc, the leading Islamic bank in Nigeria has continued to sustain its growth trajectory in spite of the challenging business environment as shown in its 2022 half-year unaudited financial performance as contained in the Bank’s unaudited financial results for the second quarter ended 30 June 2022 released recently to the Nigerian Exchange Group (NGX).

Since its debut, exactly a decade ago, the Nation’s premier Non-Interest Bank has maintained its leadership role by deepening this alternative model of financing, thus providing the foundation for its expansion, and providing the needed ethical funding for infrastructural development in the country.

The Bank, in the first six months of 2022, recorded a 27.6% increase in Profit After Tax (PAT) from N1.99 billion declared in June 2021, to N2.54 billion at the end of June 2022.

Given the performance, the Bank’s total income increased by 17.8% during the review period, from N8.86 billion for the six months ending June 2021 to N10.44 billion for the half year ending June 2022.

Meanwhile, the Bank’s earnings per share increased by 8.25% during the period under review, from 6.78 kobo for the second quarter of 2021 to 7.34 kobo at the end of the second quarter of 2022.

The positive earnings result is undoubtedly reassuring, to all stakeholders and the public. It underscores the role of Jaiz as the pioneer Non-Interest Bank in Nigeria, as well as the industry leader.

In response to the outcome, Managing Director/CEO of the Bank, Hassan Usman, stated that the Bank remained committed to providing value-creating ethical banking services to its growing customer base. He assured that the Bank is positioned to continue its remarkable earnings streak for the remainder of the year, by leveraging on technology and extending its touch points across the country.

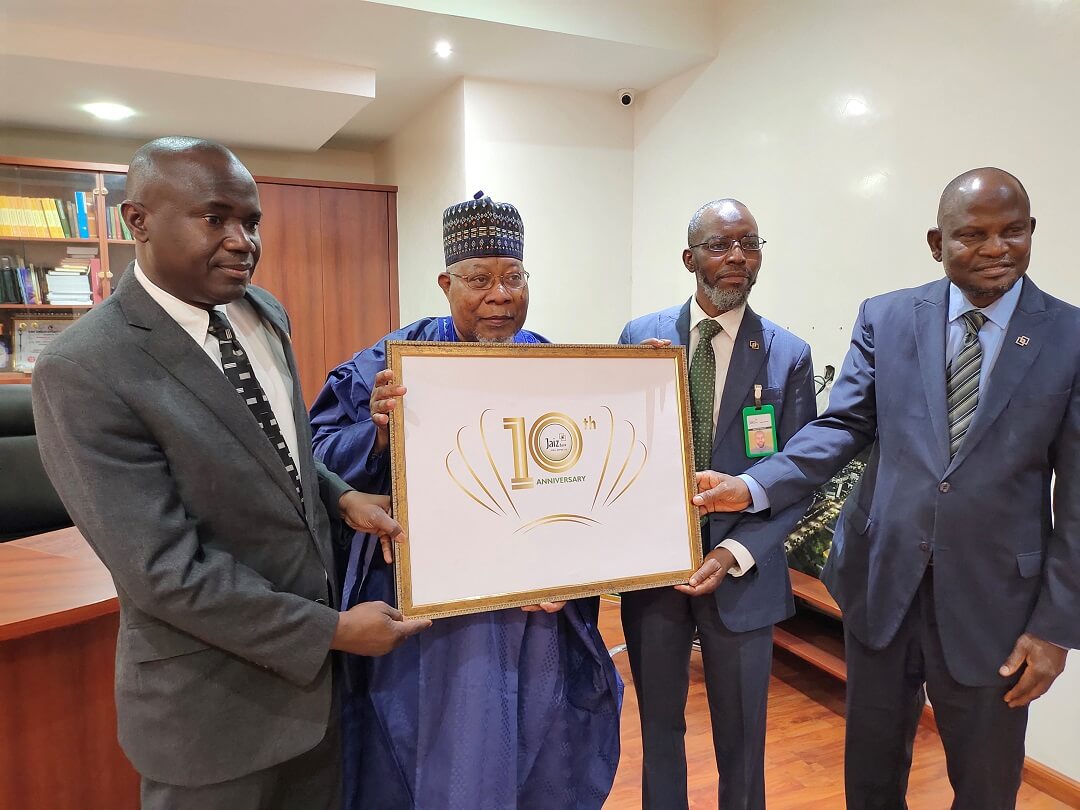

Meanwhile, the pioneer Non-Interest Bank in Nigeria, Jaiz Bank Plc clocked 10 years this year, having commenced operations on the 6th of January 2012 with three branches in Abuja, Kaduna and Kano.

Despite paying the huge costs associated with pioneering, the Bank was able to break even within the first three years of operation, which was unprecedented at the time. From a modest Balance Sheet size of N12 billion in 2012, the Bank closed 2020 financial year at N278 billion (Total Assets & Contingents) and grew all other key performance indices exponentially over the years.

Through its’ unique value proposition, Jaiz Bank has, within a decade, made a remarkable impact in empowering women, driving financial inclusion and supporting various strata of businesses in the real sector of the economy, Agriculture, Real Estate, Construction, Oil & Gas, General Commerce, etc.

Within this period, the Bank was rated by the Islamic International Rating Agency (IIRA), assigning it an investment grade rating of BBB. Most recently, the Bank also got an upgrade from both Agusto and GCR to BBB and BBB- respectively with a stable outlook. Besides, Fitch also did its’ first rating of this promising institution, and it came out at the same impressive level.

It was therefore not surprising that the Bank gained international recognition as it won the Most Improved Islamic Bank award for 2020 and 2021 consecutively from the Global Islamic Finance Awards (GIFA), among other accolades.

The Managing Director/CEO, Hassan Usman while thanking Allaah (The Creator of all), then the regulators, customers, Board, Management, staff and other stakeholders for their tremendous support, expressed great delight in the giant strides being taken by the Bank.

He said: “Today, our Bank officially clocks ten years since it first opened its doors to customers on the 6th of January 2012. The journey was much like a roller coaster – you experience some degree of fear at the onset, but subsequently, excitement takes over when the carriage takes off and you feel that euphoria of defying the odds of gravity. After the take-off, momentum is gradually gathered and stopping the coaster becomes not an option, the wisest thing to do is making every jerk and movement worthwhile and impactful. That is what we did, we lived every moment, learning from each mistake, supporting our customers through thick and thin while pressing on – despite the absence of essential non-interest banking enablers – to pioneer a nascent sub-sector that is now bourgeoning with players and accolades.

“We are happy to pioneer an industry that was not there; creating confidence for other people to come in; and we believe that we’ve done that very well. The year 2022 is special to us as it marks a decade of progress in our Islamic banking journey and I am extremely fulfilled for the opportunity of leading the team for a larger part of the journey. From a very humble beginning in 2012, the Bank has successfully developed a remarkable brand that is iconic both locally and internationally.

“You may recall in 2021, analysts at Nairametrics adjudged the Bank as the fastest growing among the listed banks in Nigeria (39.3% growth in Total Assets, based on December 2020 results) as well as the 4th most efficient based on Return on Equity (17.4%). According to the international annual ranking by “The Asian Banker” (A Singapore-based leading provider of strategic intelligence on the financial services industry), Jaiz Bank ranks 36th on the World’s strongest Islamic Banks as at 2021. We remain true to our Vision by building the second largest non-interest bank in Sub-Saharan Africa in just 10 years.

The Bank is poised to leverage on its’ market acceptance and continue to innovate in order to consistently deliver superior customer experience in the dynamic business environment, hence maintaining its clear leadership in the non-interest banking space.

Ideally, Jaiz Bank Plc, the pioneer Non-Interest Bank in Nigeria has been providing ethical services to individuals, corporate and government entities since 2012 with the mission of Making Life Better Through Ethical Finance.

Since its debut, exactly a decade ago, the Nation’s premier Non-Interest Bank has maintained its leadership role by deepening this alternative model of financing, thus providing the foundation for its expansion, and providing the needed ethical funding for infrastructural development in the country.

Interestingly, within this period, the Bank has won notable international and local accolades, amongst which are the Most Improved Islamic Banking awards in 2020 and 2021, respectively, from the Global Islamic Finance Awards (GIFA).

It is worth noting that the Bank maintains the record of being the first Islamic Bank in the world to breakeven within the first three years in operations even when there was no Islamic banking and finance instruments to invest on in the country.

Jaiz Bank’s core values are built on seven principles with the acronym RESPECT: Responsibility, Entrepreneurship, Simplicity, Partnership, Excellence, Customer Focus and Trust. These core values drive the Bank towards achieving its vision to be the clear leader in ethical Banking in Sub-Saharan Africa.

As of 31st December 2021, the Bank’s Total Assets grew by 19.55% from N233.60 billion recorded in 2020 to N279.28 billion while Shareholders’ Funds for the period grew by 36.20%, from N17.85 billion to N24.31 billion.

Non-Interest Banking is a growing global phenomenon practised in nearly 80 countries across the world including the United Kingdom, Canada, the United States of America, the United Arab Emirates, Malaysia, China, Singapore, South Africa, Kenya etc. Global Banks like HSBC, Citibank, Barclays Bank, Standard Chartered etc. are also offering non-interest banking products and services.

It is an alternative financial service offering that is open to all, irrespective of race or religion. It is based on the ethical principles of fairness, transparency and objectivity. Non-Interest Banking offers almost all the services of conventional banks.

The difference is that Islamic Banks do not give or receive interest, nor finance anything that is harmful to society like alcohol, tobacco, gambling etc. They also avoid gharar- speculation, extreme uncertainty and deception. A significant portion of the Nigerian population is desirous of ethical banking services which Non-Interest Banking is poised to deliver.

In a nutshell, Non-Interest Banking is real-economy oriented where profit and loss sharing arrangement, markup, leasing and partnership are mostly the mode of financing.

The business potential for a Non-Interest Bank in Nigeria is enormous as such an institution has long been awaited by a large population of Nigerians from all parts of the country. Jaiz Bank’s strategic business focus is mainly on retail banking, the Bank nevertheless offers corporate and commercial banking services. The Bank’s retail focus will enable it to service the majority of Nigerians who wish to do away with Riba (Usury) in their daily activities.