Cornerstone excites customers, eyes top industry’s position

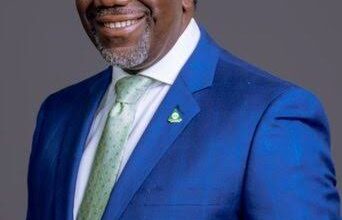

Mr Ganiyu Musa, MD/CEO

The insurance industry in Nigeria is evolving and as the industry is making progress, some insurance companies are also going with it in the same direction and one of such companies is Cornerstone Insurance Plc.

Cornerstone is a composite insurance company established in 1991 to conduct Insurance business in Nigeria in a professional, ethical and customer-focused manner.

The company came during the time the industry was in dire need of insurance companies that will drive change and take the industry to the next level. In order to excite its customers and ensure it remains ahead of its competitors, the company has remained committed to value creation and prompt claim settlement.

As one of the leading insurance companies in the country driven by technology and customers’-centric services with quality products tailored at meeting the needs of its teeming customers, Cornerstone insurance continued to remain resilient on all fronts.

As the first insurance company in Nigeria to provide customers with an online platform for insurance transactions, little wonder why Cornerstone Insurance Plc was adjudged as the ‘Best use of Technology, Insurance Company’ during the 2016 Nigerian Technology Awards.

Because of its quality services driven by cutting edge technology application and best in class manpower, the company is easily accessible to its teeming customers. One thing that makes the Company stands out is its ability to respond promptly to customers’ claim request.

In a recent survey by the company to gauge how policyholders view the company’s service delivery, here is what some of the policyholders said:

Policyholders’ testimonials

Akinwunmi Adebayo “Thanks for your prompt attention in this matter”; Elias Okoro Efe “Your services are quick and timely. Please keep it up”; Abelinis Limited “Cornerstone is providing excellent services”; City Pyramid Multiconcepts Nigeria Limited “Quick response to the claim is appreciated”.

According to Nlemigbo Udoka Chidinma “I got a quick response and the company show concern for my damaged car”; Strategic Outsourcing Limited “The Company was prompt to respond. Please keep it up”; Asogbon Oluwayomi “Insurance companies have begun expediting actions on customers request. Thanks for the prompt response”.

Awe Ayodeji, Olise Anthony, Olushola Adebisi, Asiegbu Chibueze, and Sigma Pensions Limited respectively described the company’s service as “Quick and Satisfactory response”; “Your service is better, has improved on timing”; “Speedy service delivery”; “Prompt service from my insurance company” and “Prompt services-keep it up”.

Sodipo Olakunle Samson “The service though could be improved on is fantastic”; Olufemi Sulaimon Soga ” I Never believed anything about Insurance until now. Cornerstone all the way “; Oluwabukola Oladimeji ” This is the best I have seen from insurance “; Ajayi Olusegun Babatunde “I am glad to be using this insurance because they didn’t waste time and they are fast ” and Health Plus Limited “Excellent prompt service and payment ” and Olaoti Ifeoma Justina “Responsive insurance firm, your services are prompt & reliable. I will renew my car insurance”

2020 financial scorecard

Meanwhile, Group Managing Director/CEO of the company, Mr Ganiyu Musa said the Company has paid a total of N4.6 billion claims in 2020, while growing its top line to N20 billion within the same year which characterized by business disruptions from the outbreak of the COVID-19 pandemic.

Musa in a media interview recently in said Cornerstone has been able to mobilise its capital base above the N9 billion recapitalization requirement by the National Insurance Commission (NAICOM).

According to him, “We are covered. We have no fears. We have shareholders’ funds of about N13 billion. We are fortunate enough belong to a group where our principal shareholder (African Capital Alliance) has more than $1 billion in assets. Capital is not an issue for us. If there is the business opportunity, we have access to the capital to be able to write the business.”

The Group’s CEO said “Because of the strength of our balance sheet, our investment yield was also very strong. We had a positive underwriting result.”

He said the firm also recorded a surge in rates of insurance policy, especially in life insurance in 2020. “Suddenly people saw the value in that. We did see an improvement in the uptake for life insurance even though at the same time we also saw an increase in the claim, essentially not so much from the pandemic but from the #EndSARS protest. We saw a spike in claims from the #EndSARS protest,” he stated.

Musa who is also the Chairman of the Nigerian Insurers Association (NIA) said in 2020, the group grew its gross premium by more than 30 per cent and we made a total comprehensive income of almost N3 billion in 2020. “That’s coming in the back of 2019 that was also a very stellar performance. Our growth is not a paper growth. It is backed by the significant increase in our liquidity; not just an increase in liquidity, the quality of the assets. That’s why we are able to beat our chest and say that we would settle all your valid claims. In terms of the core tenets of insurance, our word is our bond and we back that word up with our financial standard,” he stated.

He said the company’s operations were never affected by the coronavirus-induced lockdown last year, adding that they never missed any deadline or meeting. Mr Musa said the organization leveraged its existing robust technology base to conduct its operations. “We had the technology that enabled us to take more transactions in 2020.”

On his part, Cornerstone’s Executive Director, Business Development, Mr Chidiebere Nwokeocha said the firm is coming out bigger in 2021 with more technology-driven growth. “In 2021 you are going to see a solid Cornerstone so robust, coming out to dominate the industry. By the end of 2021, we are going to be among the first three or first four insurance companies in the country.