We’ve Built A Solid Foundation For Future Cornerstone – Alangbo

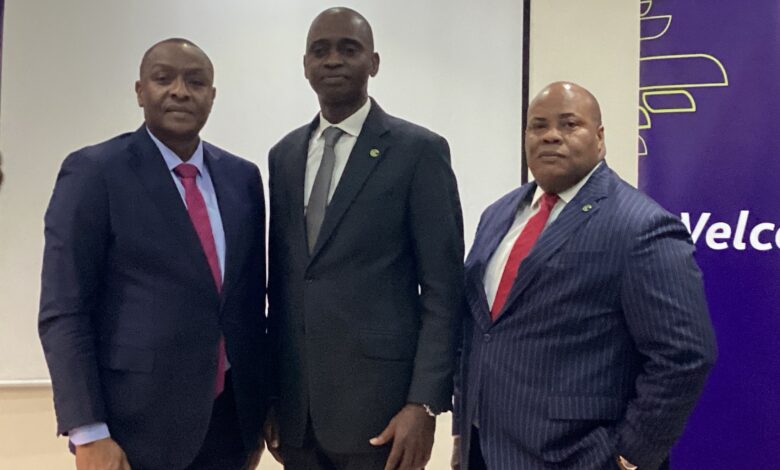

L-R: Mr. Chidiebere Nwokeocha, Executive Director, Business Development and Chief Client Officer; Mr. Stephen Alangbo, Managing Director/Chief Executive Officer and Mr. Peter Ekwueme, Executive Director, Technical, all of Cornerstone Insurance PLC during the press conference organised in celebration of the MD/CEOs one year in office in Lagos on Friday, July 5, 2024.

The Managing Director/Chief Executive Officer of Cornerstone Insurance Plc, Mr. Stephen Alangbo, said with the restructuring of the Company’s retail business segment, improved relationship with partners, the introduction of new products, improved service delivery, united workforce, technology adoption, they have built a solid foundation for a future Cornerstone.

Alangbo said this while highlighting some of his achievements at a media chat to celebrate his one year in office in Lagos on Friday.

He said their determination to build a united and successful company has been achieved, noting that the Company is more united now than before focusing on driving the growth of the Company.

Alangbo said the Company has reorganized its processes and embraced technology for improved service delivery, adding that they have redesigned its products and developed new ones to meet the needs of its clients.

“Our determination to build a united company has been achieved and that is why we achieved the mileage that we had. I want to inform you that we have a united team that has a single focus – ‘One Team, One Goal’ which is propelling Cornerstone forward.

“We have created a partnership that created a platform for us to have a company of our dreams.

“We have restructured the retail business. If you recollect during our last parley, I said we are going to give more attention to retail, am happy to inform you that we have done a lot of work as regards retail and we have created a solid foundation for future Cornerstone.

Aside from this, we have improved our processes by applying technology to support our business, to ensure that our services are second to none, and our clients are happy.

“Our focus was for us to be the best in Nigeria but we have gone beyond Nigeria. Recall that recently we were recognized as the Best Insurance Company in Africa. This is a result of the hard work of the team – our innovation, resilience, and creativity. I was also nominated as one of the African CEOs of The Year but it was won by a lady from Ethiopia, we are resolute and determined that we will not only win the Insurance Company of the year, we will win the CEO of the year and other awards that are available in subsequent conferences.

“We have redesigned our products and we have new products that we have introduced and this is giving us some of the successes and improvement and numbers you are seeing,” he said

He said the Company will continue to do whatever is necessary to penetrate the market. “We will continue to do whatever is necessary to penetrate the market by giving the people the product that is relevant to them because that is our promise and we are keeping to our promise.

On branding, he said, “We will continue to improve our branding and we will continue to make our brand strong and visible.”

He said the Company’s relationship with the brokers and other partners is fantastic. “We have improved our relationship with our partners including brokers, and corporate clients, and that is part of what is supporting the achievements that you are seeing today.

“We want to commend our partners for supporting us which is what made us to win the award and we are dedicating the award to all our partners who, over the years, have supported us in one way or the other”.

He said the Company’s performance for 2023 was very good, reflecting a significant growth in the organization, stating that the account will be published any time this month.

“For top line, we have recorded about 40 per growth in our business. For profitability, we have moved from N2.9 billion in 2022 to N17 billion as at the end of 2023. It’s been very wonderful. The team had worked tirelessly to ensure that our visions, our dreams, and our goals were achieved.

For our future outlook, we are expecting an unprecedented result. I am expecting a mind-blowing result. If in the last year, we have been able to achieve N17 billion and African Insurance Company of The Year, you can see a sign that the future is bright. Let me tell you as a person, and as the leader of the team, I always believe that with the help of God and hard work, we can achieve whatever we want to achieve and that is our goal. Our vision is to be a global institution. Since we are known in Africa, we will strive to be a global institution and that is our goal.

He said in the face of persistent economic hardship the Company will continue to find ways to support its customers and shareholders and promised to put smiles in their faces.

“As a dynamic organization, we will continue to see how to support our clients in the area of product design, and prompt claim settlement when there are claims. We are also going to give priority in risk assessment to ensure the protection of our clients because when they are protected and there is a proper assessment of their risk, that can lead to reduced premiums because everybody wants to save premiums or income that is part of our strategy and we will continue to give them information on developments on how to improve their risk, on how they can get their claims paid, these are some of the things that we are doing,” Alangbo said.

“There will be customized products that will meet the dynamic needs of the insuring public. We will be closer to our clients than how we used to be in the past. We are designing these measures to ensure that our clients get the best from us.

“We are also designing bonding products to ensure that our clients get maximum benefit from some of the policies they are buying from us.

Speaking on the Insurance industry, he said he has advocated recently that the insurance industry can achieve penetration through life products.

In my presentation yesterday, I said as an insurance institution that we can only achieve insurance penetration through life products. The reason is that we have over 200 million people in Nigeria and every person can buy Life Insurance. The indication is that the number of policies we have in Nigeria is less than five million. We have the potential to achieve over 200 million policies in Nigeria. That will come from Children’s Education Policy, Life Expense Cover for the elderly, Annuity Products for retirees, Saving Products for the employed and Personal Accident Product.”