Tier-based Recapitalisation: Ogunbiyi calls for caution

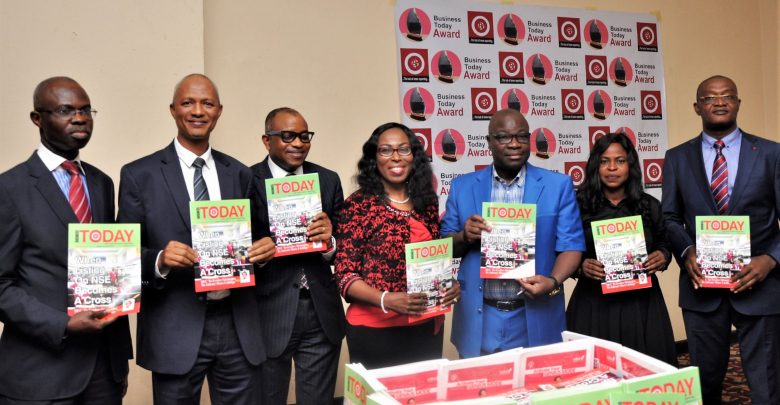

L-R: Mr. Benedict U. Ujoatuonu, Managing Director/CEO, Universal Insurance Plc; Dr Farouk Aminu, Head, Research & Strategy Management Dept, National Pension Commission; Mr. Olaotan Soyinka, Managing Director/CEO, Sovereign Trust Insurance Plc; Dr ( Mrs.) Tonia Smart, MD/ CEO Yorkcity Consult Ltd; Dr. Akin Ogunbiyi, Chairman of occasion; Nkechi Naeche, Publisher/CEO, Business Today, and Mr. Glory Etaduovie, Managing Director, IEI-Anchor Pension Managers Ltd, launching Business Today magazine during the 5th anniversary/Award held in Lagos on Tuesday

The Chairman, Mutual Benefits Assurance PLC, Dr. Akin Ogunbiyi, has expressed worry that the implementation of the recently introduced tier-based recapitalisation by the National Insurance Commission (NAICOM) could be counter-productive, anti-growth and disruptive to the insurance industry.

He also identified unhealthy competition, unethical way of doing business, popularly called rate-cutting, inadequate technical know-how, and lack of insurance penetration as big road-blocks in the way of development and growth of the industry.

Ogunbiyi said what the industry need is to urgently adopt a value innovation strategy to enable it provide relevant affordable products for the teeming population, advising as a priority, the alignment of insurance services to the unique lifestyles of the citizenry in all income groups.

It should be recalled that the Federal Government, through NAICOM, had recently introduced a 3 -tier based recapitalisation for the insurance industry, giving 1st of January, 2019 as the commencement date.

Ogunbiyi, who was speaking as the Chairman of the occasion at the 5th BusinessToday Anniversary and Awards at Sheraton Hotel, Ikeja, Lagos, Tuesday, said that immediate implementation of the Tier based rating could lead to crisis of confidence for the entire insurance industry where only about seven of the 29 companies qualify under the new standard.

He stated that this could also lead to massive de-listing of Insurance stocks from the Nigerian Stock market, he stressed that insurance stocks are already classified as penny stock due to inability to support pricing by regular dividend payments.

Ogunbiyi said it would lead to hostile take-overs for peanuts, especially by foreign investors with short term gains as focus.

He pointed out that it might as well be practically impossible to fully implement the provision of the Local Content law, even as the rebranding project of the insurance industry may suffer a major set- back while the public perception of some companies and the entire industry will be affected adversely.

Stating that the Tier based capital requirement whereby a Tier 1 composite insurance company would require a solvency capital of N15bn, is the highest in African insurance market, he pointed out that the solution to challenges facing the industry is not capital increase.

Taking a cue from National Pension Commission (PenCom), he said the Commission is yet to increase the capital base of Pension Fund Administrators (PFAs) and Pension Fund Custodians (PFCs) from N2 billion and N5 billion respectively, 14 years after inception, yet, they are managing and have grown the pension assets to about N8.2 trillion, while the insurance industry who keep on recapitalising is nowhere near this feat, which suggests that the capital base might not be the problem.

“Is it only capitalisation that can drive insurance development in Nigeria giving the experience of other African insurance markets? What has been the contributions and performance of the industry since the 2007 recapitalisation exercise? What level of returns (Return on Equity/Return on Investment) have accrued to the investors and shareholders of the industry ever since? Who are the target investors expected to shore up the new capital call even if there was time?” he queried.

Ogunbiyi said, today’s shrinking profit pool and the overall performance of insurance industry can only be checkmated by innovation, technical capacity, healthy competition, adoption of best practices, governance structure and creating ‘blue oceans of untapped new markets.’

“As an industry, we need to urgently adopt a value innovation strategy to enable us provide relevant affordable products for our teeming population. My advice is that as a priority, we must align insurance services to the unique lifestyles of our citizenry in all income groups,” he advised.