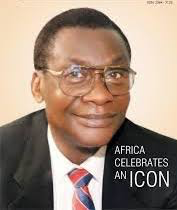

Nigerians Shower Encomiums, Extol The Legacies of Late Prof Irukwu Who dies At Age 89

When the news of the demise of Prof (Chief) Joseph Ogbonnaya Irukwu, SAN, CFR., was made public yesterday through a statement by Prince Harrison Eze Okorie, president general, Amaokwe Item Welfare Union, the nation was shocked and those in the nation’s insurance industry were severely devastated.

In the statement which described Prof Irukwu’s death as the glorious but painful demise, the union, on behalf of Amaokwe Community, commiserated with the family and pray to God to grant his soul peaceful rest.

“The union enjoins all Amaokwe sons and daughters to mourn the exit of this giant as we also remember to uphold his family in prayers in this moment of grief,” the statement added.

Some of those who spoke on Prof Irukwu’s demise included Prince Harrison Eze Okorie, president general, Amaokwe Item Welfare Union; Former President of Ohanaeze Ndigbo, Chief Gary Enwo-Igariwey; Dr Joe Nworgu, former secretary general of the Ohanaeze Ndigbo; President, Chartered Insurance Institute of Nigeria (CIIN) Mr. Edwin Igbiti; Executive Secretary/Chief Executive Officer, Nigerian Councill of Registered Insurance Brokers (NCRIB) Mr. Tope Adaramola and Management Consultant and Founder/Chief Executive Officer, Finterate Projects, Mr Ekerette Ola Gam-Ikon.

Irukwu, a lawyer, lecturer, author and insurance guru, was the founding managing director of Nigerian Reinsurance Corporation. He also founded African Development Insurance Company thereafter, which was later sold to Diamond Bank.

Mourning his demise yesterday, some present and past leaders of the apex Igbo socio-cultural organization including high ranking personalities in the Nigerian Insurance industry extolled his virtues, stressing that he was a role model and outstanding leader that served the nation, the insurance industry, his Igbo nation and humanity well.

Former President of Ohanaeze Ndigbo, Chief Gary Enwo-Igariwey, while mourning late Irukwu expressed shock at the news, saying that “it’s a painful news, but he lived a very good life, rendered service to the Igbo nation and to humanity in general, excelled and made his mark in his chosen profession, Insurance.

“Also, he made his mark in Africa and beyond, in the insurance world. So after such great service, we can only bid him farewell. May his great soul rest in peace,” he said.

Also, Dr Joe Nworgu, former secretary general of the organization, expressed shock at the demise of Irukwu.

“I am shocked at the news that you are just giving me now. I am not aware of this until now. It’s very unfortunate, I am sad about it. May his gentle soul rest in perfect peace,” he prayed.

Also speaking on the exit of the elder-statesman, President, Chartered Insurance Institute of Nigeria (CIIN) Mr. Edwin Igbiti, said that a hero is gone, adding that his contributions would be greatly missed.

He noted that the late Irukwu was the first professor of the institute and that he contributed immensely to the growth and development of the institute.

He noted that Irukwu was the only Professor the institute had and that he contributed greatly to the growth and development of the institute.

Executive Secretary/Chief Executive Officer of the Nigerian Councill of Registered Insurance Brokers (NCRIB) Mr. Tope Adaramola, in his Article titled “Professor Joe Irukwu: Eclipse Of Insurance Intellectualism,” highlighted the life and time of late Prof Irukwu including his contributions to the Nigerian insurance industry in particular and the nation’s development in general as well as how he will be missed.

According to Tope, “It’s no doubt a gloomy period in the Nigerian Insurance as another glittering star has dropped from its firmament, with the passage of the iconic Professor Joseph Ogbonnaya Irukwu, SAN.

He said “The deceased bestrode the industry and financial sectors of the nation for so many years as a colossus, leaving behind a void that would be quite difficult to fill for a long time.

“There was hardly any constituent of the industry that was not positively impacted by Irukwus professional sagacity and intellectual sapience. In his hey days, Prof Irukwu was insurance while insurance was incomplete without him. Those who had not met him, knew or must have encountered his works. He was able to occupy such a huge space in the industry partly due to a combination of his solid legal background, fine mind, and unignorable physique as a six footer. With his a rich faculty and often lovely finery of suites, Irukwu often stood out distinctly amongst other personalities.

“Trained in the UK in the early years as a lawyer, and later a chartered Insurer, his insurance career came to public glare as the pioneer Managing Director of Nigeria Reinsurance Corporation where he gave the foundational leadership required of an institution of that genre in the industry in those days. Though he held sway while the one per cent legal retrocession was compulsory in the market, Professor Irukwu brought his adroit leadership and financial acumen to bear on the company to keep it as one of the most profitable institutions in the market.

“He also mentored so many budding professionals who had held and are holding commanding positions in the industry locally and internationally.

A turning point came when the General Ibrahim Babangida rejigged the leadership structure of the two insurance giants, namely Nicon Insurance Corporation (Nicon); and Nigeria Re under Irukwu.

“The duo of Late Mr Yinka Lijadu and Irukwu were retired paving the way later for Mr Ogala Osoka to head Nigeria Re while Mallam Mohammed Kari headed Nicon Insurance Corporation.

“Irukwu’s rich reservoir of insurance knowledge coupled with zeal for entrepreneurship led him to establish ADIC Insurance Company Ltd, on which platform he retained his strong and potent voice as industry leader. The history of the Nigerian Insurance industry could not be written without the roles of Professor Irukwu glaringly etched on the annals.

“As a past Chairman of the Nigerian Insurers Association (NIA) and active member of the Governing Council of the Association until his advancing age when he voluntarily recused himself on grounds of old age, Irukwu provided the legal ammunition with which the Association fought many of its legal battles, particularly when it has to stem what it perceived as unfair market or regulatory practices against its members. Irukwu had a perfect synergy of minds with other legal minds like Late Professor Funmi Adeyemi, then Executive Secretary of the Association and later Reverend Olusola Ladipo-Ajayi,” Tope said in his article.

The NCRIB CEO noted that “It is on record that Prof Irukwu and others on behalf of the NIA combated the National Insurance Commission (NAICOM) on several grounds, one of which was on the directive by the Commission in 1998 that all funds already accumulated by the NIA under its security fund for hit and run uninsured motor vehicle victims should be paid into NAICOM as stipulated by the Insurance Act of 1997. NIA claimed that the law could not be applied retroactively, hence resorted to the courts. Irukwu led the thoughts of Governing Council to ingeniously seek a way the funds could be utilized for the benefit of its members, and that was what impelled the purchase of a duplex building belonging to one Mallam Shehu Musa at Number 42, Saka Tinubu Street, Victoria Island Lagos as the NIA first personal building. It is the same ground on which the newly built exquisite NIA Building is standing today.

“Also of note was the combat between the NIA and NAICOM on the interpretation of the Insurance Act with regards to the expected professional qualifications that Managing Director of an Insurance Company must possess. Irukwu, et al, had argued that the headship of any insurance institution needed only an insurance certification, positing that insurance is both a profession and business, from which shareholders are concerned about more about returns on their investment (ROI). They conceded to the fact that the head of technical department of such companies must be professionally certified by the ACII or AIIN as the case may be. Regretfully, before the conclusion of the matter, some Managing Directors of NIA member companies had resigned their appointment, though the submission of NIA later assailed.

“Irukwu was a face between the insurance industry and government, oiling the lobby process with government in high quarters. This writer reminisces a visit of the NIA powerful delegation to the presidency under the then nascent democratic regime of Chief Olusegun Obasanjo. On gaining access to the presidential Villa, Obasano’s first statement was “where is Joe?” “If he is not here, then the meeting is considered done”! Thankfully, Joe was one of the leaders of the delegation.

“Time and space would not suffice to highlight all the imprints of Professor Irukwu as one of the respected leaders of the insurance industry under the umbrella of the Chartered Insurance Institute of Nigeria (CIIN). He pioneered the Legal Committee of the NIA through which legal minds in the Association often had convergence of minds to handle legal issues affecting their individual companies and the Association. We cannot miss the fact that he remained an irrepressible voice in international discourses about insurance and risk management. An intellectual and teacher of teachers, Irukwu’s literary grace enabled him to teach insurance law in many universities and colleges in Nigeria as well as overseas.

“He also churned out multitudes of books and literatures on such subjects as Insurance Law, Law of Contracts, Corporate Governance and Reinsurance, etcetera. These books became ready manuals for students of insurance in higher institutions in Nigeria and abroad, as well ready companions for professionals and members of the public desirous of continuous knowledge about their practice.”

Tope Adaramola said “Despite his tight professional calling, Irukwu had a superb connection with his Igbo roots. He rose meteorically to the position of Ohaneze Ndigbo worldwide, where he gave a good account of himslelf as a leader of classS. His absence from major public insurance functions due to advancing age created a void in insurance conversations and now there is a bigger void created in the industry with his sad demise.

“The entire insurance industry would have aligned in this grieving moments with the Chinese saying that when an old and resourceful man dies a library is completely burnt, but for Irukwu’s rich collection of timeless thoughts embedded in the professional books and literatures he left behind. Same for his imprints in the hearts of those he touched their lives in an uncommon way as a mentor, leader and boss while he still had the breath of life.

“Adieu “Mr. Insurance” Professor Irukwu, as we keep solace in the rich memory of your astute leadership and impact on our world!”

Also speaking, a Management Consultant and Founder/Chief Executive Officer, Finterate Projects, Mr Ekerette Ola Gam-Ikon expressed shock over the passage of Late Professor Joe Irukwu, whom he described as a professional in law, insurance law, insurance, entrepreneurship and governance, adding that he will be missed by many people across the world.

“His contribution to the growth and development of the insurance industry in Nigeria and Africa is incomparable given the number of books he authored on different aspects of insurance especially Insurance Law.

“His contributions to the process of amendment of the Insurance Act 2003 would also pass as a distinctive one when he served as Chairman of the Committee set up by the Federal Government to review the laws.

“I also recall that Prof. Irukwu was behind the launch of the publication “A Century of Insurance in Nigeria” by the Nigerian Insurers Association (NIA),” Ekerette said.

He said Prof Irukwu served in various capacities within and outside the insurance industry but always ensured that the industry benefited from them which, according to him, earned him the respect of his peers and fellow professionals in insurance.