Nigerian Insurance Market Grows By 35% To Over N1 Trillion In 2023

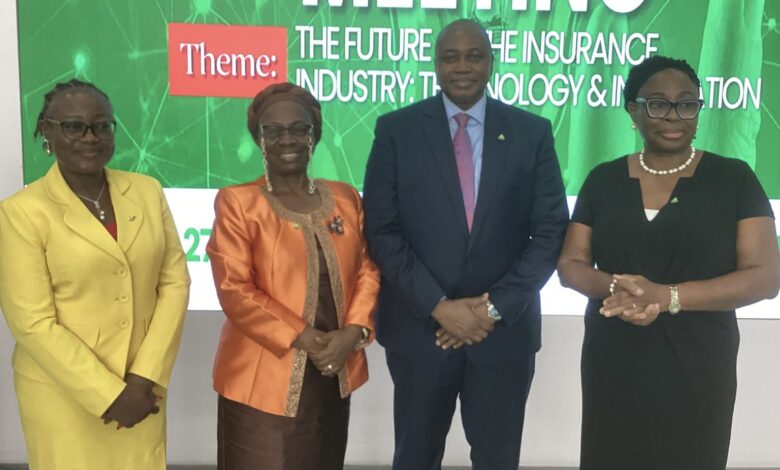

L-R: Managing Director, Enterprise Life Nigeria; Funmilayo Omo; Outoging Director-General, Nigerian Insurers Association (NIA), Mrs. Yetunde Ilori; Chairman, NIA, Kunle Ahmed; and Director-General, NIA, Mrs Bola Odukale, during the 53rd Annual General Meeting of NIA in Lagos on Thursday.

The Nigerian insurance companies in 2023 grew gross premium written by over 35% to over N1 trillion, even as they paid N669.4 billion claims to their customers during the period under review, as part of their duties to boost economic develop and reduce the impact of losses in the society.

The Chairman of the Nigerian Insurers Association (NIA), Mr. Kunle Ahmed, disclosed this during its 53rd annual general meeting in Lagos on Thursday.

Ahmed’s appointment as the chairman of NIA was confirmed at the meeting, this followed the recent appointment of the former Chairman, Mr Olusegun Omosehin, as the Commissioner for Insurance.

While presenting the annual report at the meeting, he said, “The gross written premium of the Nigerian insurance market was N736.2 billion in 2022, and the market achieved over 35% growth recording over N1 trillion in 2023.

“The insurance market recorded total assets of N2.67tn and capitalization of N 851bn in 2023. The net claims posted by the industry were N669.4bn, with the non-life segment contributing N329bn, while the life segment recorded N340.4bn.”

Despite this achievement, he added,, insurance penetration is still very low with efforts to raise the low rate of penetration tied to addressing persistent levels of unemployment and poverty.

Ahmed said the Association will continue to support, collaborate and work closely with the National Insurance Commission (NAICOM) and other stakeholders within the financial services sector to promote the business of insurance through the development of innovative products especially for those financially excluded, and the enforcement of compulsory insurances towards the growth and development of our industry.

The NIA boss said the Association will continue to support, collaborate and work closely with the National Insurance Commission (NAICOM) and other stakeholders within the financial services sector to promote the business of insurance through the development of innovative products especially for those financially excluded, and the enforcement of compulsory insurances towards the growth and development of our industry.

He also said the Association made efforts to ensure the Consolidated Insurance Bill 2023 was signed into law during the last administration, but this was not achieved.

“Concerted efforts are being made by the Association to ensure the new revised bill named – Nigerian Insurance Reform Bill 2024 currently on the floor of the Senate of the 10th National Assembly is passed to reposition our insurance industry and to enable us to operate in line with global best practice,” he said.