NAICOM Strengthens Collaboration With EFCC To Fight Financial Crimes

National Insurance Commission (NAICOM) has strengthened collaboration with Economic and Financial Crime Commission (EFCC) in combating money laundering, fraud and other financial crimes, to ensure the growth of insurance sector.

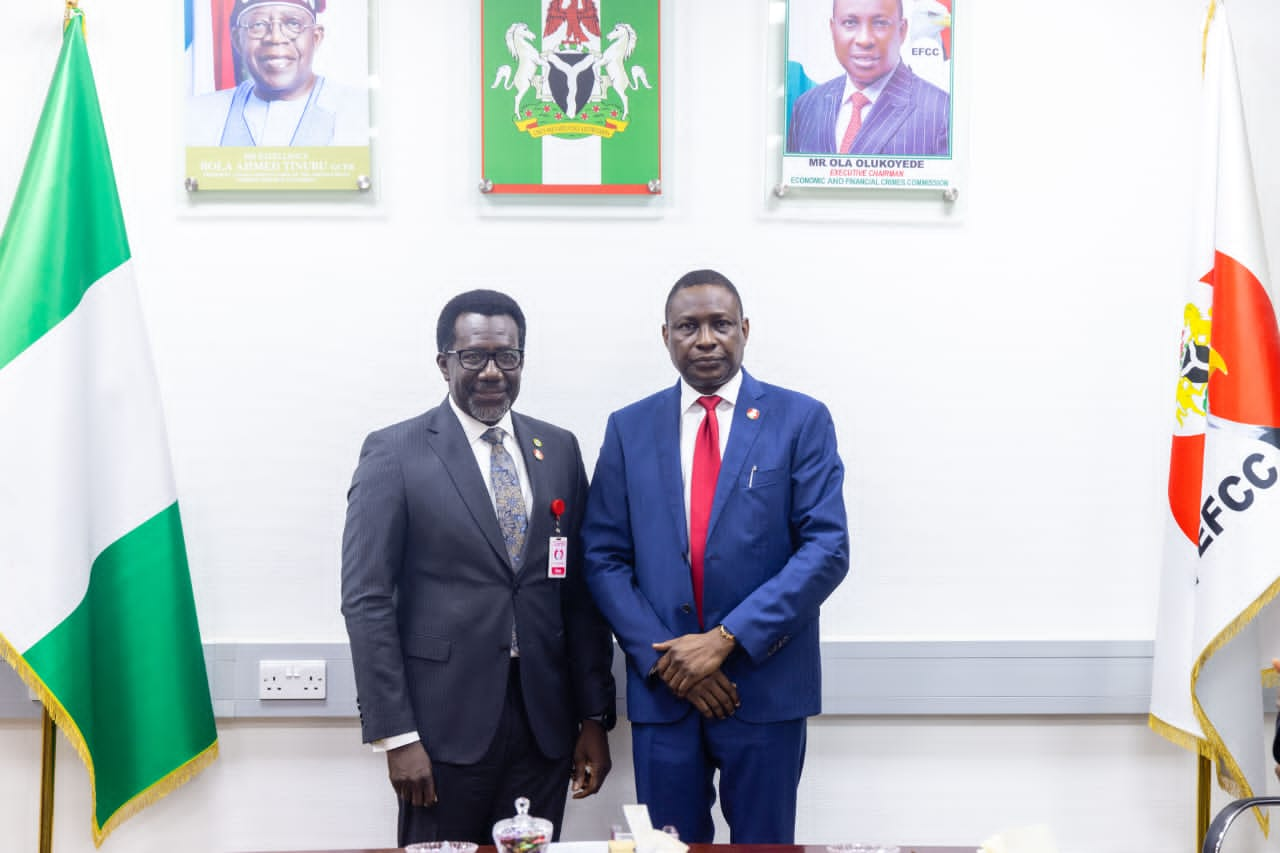

This was the outcome of the visit by the Management of the National Insurance Commission (NAICOM) led by the Commissioner for Insurance and Chief Executive Officer, Mr. Olusegun Ayo Omosehin to the Headquarters of the Economic and Financial Crime Commission (EFCC) in Abuja on Wednesday, 13th November, 2024.

In his remark during the visit, Mr Omosehin highlighted the mandate and core functions of NAICOM, which include regulating, supervising and developing the insurance industry in Nigeria, acting as adviser to the Federal Government on all insurance related matters and more importantly ensuring the protection of policyholders, and public interest.

The NAICOM boss further stated that the visit was aimed at strengthening collaboration and partnership between NAICOM and the EFCC as agencies of the Federal Government especially in combating money laundering, fraud and other financial crimes that are affecting the growth of the insurance sector.

He expressed confidence and optimism that the new leadership of the EFCC under Mr. Ola Olukoyede will continue to provide necessary support to NAICOM to continue to strengthen and sanitise the Nigerian Insurance Industry.

The EFCC Chairman, Mr. Olu Olukoyede in his response thanked the Commissioner for Insurance and members of his team for the visit and assured them of EFCC’s full support in the ongoing effort by NAICOM to strengthen and sanitise the sector, preventing financial crimes and ensuring protection of policyholder’s interests and rights.

He stated that the insurance sector has great potentials for growth looking at other countries where insurance drives their economy.

The EFCC Chairman Mr. Ola Olukoyede, pledged to support financial regulators in monitoring regulated entities and investigating financial crimes. He also emphasized EFCC’s commitment to sanitizing insurance industry through robust enforcement of financial laws and regulations.

He stated that the EFCC aims to insulate the insurance sector from rogue activities, ensuring stability and sanity. To achieve this, Mr. Olukoyede promised to bolster the department overseeing banking and insurance activities, giving special attention to the insurance sector.

The meeting agreed that strengthening the partnership between the National Insurance Commission (NAICOM) and the Economic and Financial Crimes Commission (EFCC) is a crucial step towards creating a more secure and stable insurance sector in Nigeria.

By working together and sharing information, the two agencies can effectively sanitize the industry and ensure the achievement of their mandates.