Local Content: NAICOM Restates Commitment To Creating Enabling Environment, Enhancing Capacity Of Insurance Institutions

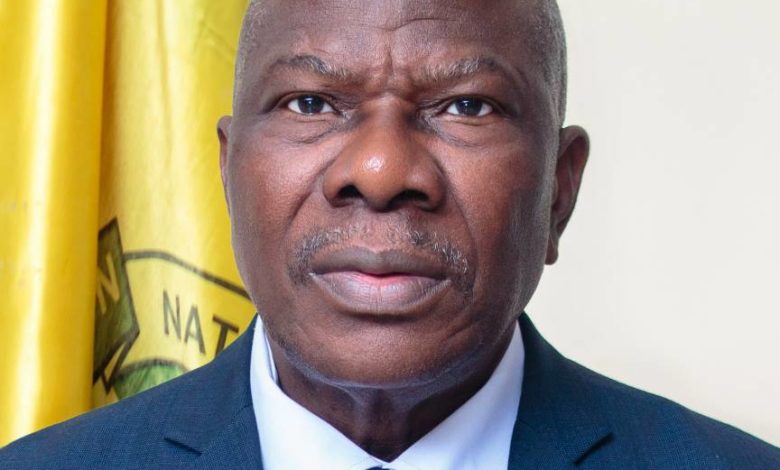

Mr. Olorundare Sunday Thomas, Commissioner for Insurance/CEO, NAICOM

*Calls On Oil & Gas Sector Operators To Comply With Relevant Guidelines

The National Insurance Commission (NAICOM) has reiterated its commitment to creating an enabling environment that will consistently enhance increased capacity of the Insurance Institutions both financially and technically in line with the Guidelines for Oil & Gas Insurance Business issued in 2010.

The Commission also called on Operators in the Oil and Gas sector, to ensure timely compliance with the requirements of the Guidelines jointly issued by the NAICOM and Nigerian Content Development and Monitoring Board (NCDMB) in pursuant to the requirements of Sections 49 and 50 of the Nigerian Oil and Gas Industry Content Development (NOGICD)Act 2010.

The Commissioner for Insurance/Chief Executive Officer, NAICOM, Mr. Olorundare Sunday Thomas, in his Keynote Address at the Oriental News Summit themed “Building Local Content Synergy Between The Oil And Gas And The Insurance Sector in Nigeria,” toed the path of history, highlighted the relevant laws and requirements from each party and why the synergy between the two sectors is important especially to the nation’s economic growth.

Apart from these, the NAICOM boss also listed actions taken and initiatives adopted by the Commission for a successful implementation of the NOGICD Act.

According to Mr Thomas, prior to the Nigeria Oil and Gas Industry Content Development Act of 2010 (NOGICD ACT), the Insurance Act 2003 made far reaching provisions for the domestication and domiciliation of insurance services in Nigeria.

“In particular Section 65(7) made it compulsory for any property located in Nigeria whether moveable or immovable to be insured with a Nigerian registered insurer. Section 67 requires that insurance of all imports into Nigeria must be insured by insurers registered in Nigeria.

“The Historical relationship between both Industries could be traced to the birth of the latter, following the issuance of the NOGICD ACT, the Insurance Industry in collaboration with the Board brainstormed leading to issuance of The Guidelines for Oil & Gas Insurance Business issued in 2010 which amongst others, stipulates the roles and responsibilities of insurance institutions in ensuring compliance with local content law, with the primary consideration of ensuring actual exhaustion of available In-Country Insurance Capacity.

“The overall aim being development of indigenous content through increased indigenous participation,” NAICOM boss explained.

He said “The journey for the renewed collaboration transited to the signing and unveiling of the Guidelines on submission of Insurance Programme by Operators, Project Promoters, Alliance Partners, and Nigerian Indigenous Companies in the Nigerian Oil and Gas Industry.”

This, according to him, officially took place at the 21st NOG Energy Conference and Exhibition of 4th to 7th July 2022 at the International Conference Center Abuja.

The Jointly issued Guidelines, Thomas said, “portend to satisfy the intent and provision of the laws: thereby enabling the NCDMB monitor utilization of in-country insurance capacity which is a road to increased retention, growth in in-country technical capacity, Job creation, increased penetration and GDP growth, human capacity development, and many others.

“It is also projected that the Guidelines will entrench effective regulatory oversight. This is to be the dividend of an active approach to Joint Regulatory Framework for driving Local Content in Nigeria.”

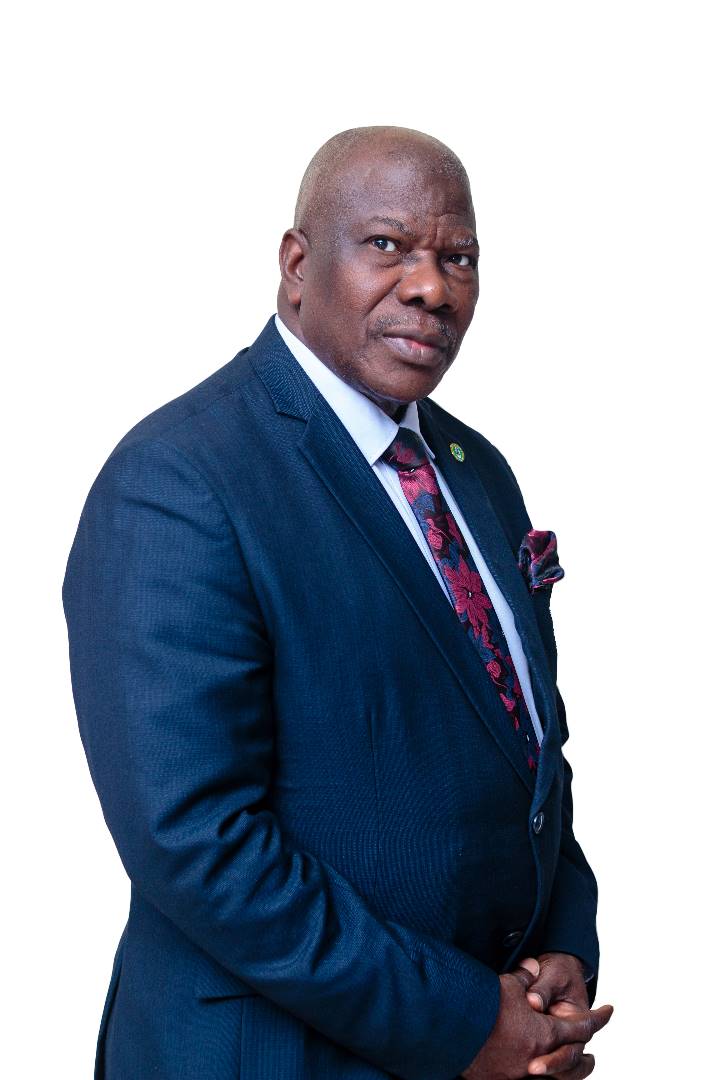

Publisher/Editor-in-Chief, Oriental News, Mrs. Yemisi Izuora, speaking at 2023 Oriental News Summit today in Lagos.

The intention of the Guidelines, he noted, “is more tilted towards encouraging preventive, detective; as well as corrective and compensatory regulatory controls,” adding that “necessity is on us to ensure that risks are accurately priced and professional advice is given to Insuring entities, especially in the Oil and Gas space, as it poses vantage position to avoiding overpricing of products, underrating of risks, negligent omission of necessary covers and its consequential effect on avoidable pressure and burden on finances.

On the benefits of the synergy between the two sectors, Thomas said “The Company’s exposures where not accurately reviewed could deter incentivization from the regulator that could be provided in future to compensate for risk improvements deployed to reduce potential environmental liabilities, or the advantages enjoyable by deploying capital on transition from high based carbon energy and its environmental impacts. This is in contemplation with the pressure to reduce Green-House Gas (GHG) emission and transition to Clean and Renewable Energy.

“A platform that aid juxtaposition of Company’s operations with the obtained Insurance coverages would enhance the pace of the Regulators’ oversight on the appropriateness of products offering to the Market. Proper profiling of the entities’ coverages will compel joint collaboration and facilitation of knowledge sharing in ways optimally beneficial to both Industries.

“The Disclosure and Reporting requirement of Section 49 of the NOGICD ACT is to ultimately enhance regulatory decisions that will benefit the Oil and Gas Industry and the Nation at large.

“Another merit of the collaboration as highlighted in the blueprint between the Board and the Commission is to bridge the identified knowledge gap in the demand and supply sides of the oil and gas insurance value chain. This would not have been possible where there is no special vehicle of research and development which engine is the access to information and data from both the suppliers and consumers,” he stated.

Thomas said “NAICOM has shown a positive attitude to Market Development with the release of the Soundbox Guidelines which is an instrument to test ingenuities in the Market; hence the Commission seek to facilitate and promote innovative insurance solutions that will address the gaps in current insurance offerings.

“….There is the urge to intensify the ongoing drive to facilitate platforms that address the demand-supply gap; encourage specialized products that addresses the needs of the Oil and Gas Industry; Address all potential regulatory impediments; Support the development of human capacity and ensure technical capacities of Insurance suppliers; Ensure adequate risk pricing and comprehensive coverages and risk management

“As the regulator, we are committed to creating an enabling environment that will consistently enhance increased capacity of the Insurance Institutions both financially and technically.”

He emphasized the need for reciprocal expectations from Operators in the Oil and Gas sector in ensuring timely compliance with the requirements of the Guidelines jointly issued by the Commission and NCDMB.