Life Insurance Firms Register 1,601 Retirees For Retiree Life Annuity In Q1 2021

The National Pension Commission (PenCom) said Life Insurance companies registered 1,601 retirees under the Retiree Life Annuity (RLA) during the first quarter of 2021.

This is contained in the Commission’s first quarter 2012 report.

The Commission said a total lump sum of N5,436,058,359.02 was approved for payment to the retirees, while the sum of N10,106,528,179.24 was approved for payment to 14 Retiree Life Providers as premium in return for total monthly/quarterly annuities of N98,330,781.49.

PenCom also maintained that it granted approval for 8,947 requests, comprising 4,173 public (FGN & States) and 4,774 private sector retirees to draw pension through the Programmed Withdrawal (PW) mode during the quarter under review. These retirees, it noted received a total lump sum of N25,160,612,257.42 while their total monthly pension amounted to N371,103,549.16.

The National Insurance Commission (NAICOM) has expressed great concern over the declining participation of life companies in the Retiree Life Annuity business, which is considered a huge emerging opportunity for the industry.

Retiree Life Annuity is a pension benefit administered by life insurance companies, which provides pension benefits for retirees all through their lifespan and estimated to have a pool of funds over N463.10 billion.

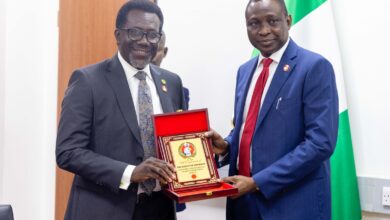

The Commissioner for Insurance, Sunday Thomas, who raised the concern, noted that operators in the insurance industry must strengthen their human and financial capital for effective participation in big-ticket risks.

“It has been observed that the gains of domestication policy of the government as enshrine in the Nigeria Content Development Act 2010 is gradually losing its meaning for the insurance sector. More businesses especially in the oil and gas and Aviation sectors are now been reinsured abroad.

“Of more concern is the declining participation of life companies in the annuity business which is the emerging business for our industry. These are the areas where the industry can impose itself on the economy through the control of funds for national development,” he posited.

According to Inspenonline, “about five life operators had cut down on their annuity business portfolio as volatility, inflationary pressure, and low returns on investment continue to hit their bottom line.

“While three of the concerned firms have suspended annuity business, for now, two of them have reduced their volume as profit from this portfolio dips.

“The underwriters reduced their risk appetite for an annuity due to the currently low profitability, just as more are expected to either suspend or slash their annuity volume in the next couple of months.”