Insurance: NAICOM unfolds strategic plans for 2020, releases 2019 scorecard

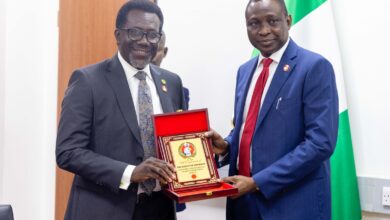

Mr. Olorundare Sunday Thomas, NAICOM boss

The National Insurance Commission (NAICOM) recently organised a two-day seminar for insurance journalists in Kano, to keep them abreast with the happenings in the industry where they (NAICOM) unfolded their strategic plans and programs for 2020 as well as released its 2019 scorecard. Edet Udoh who was there reports.

The two-day seminar started with a cocktail party at one of the newest hotels in the ancient city of Kano, Bristol Palace Hotels, located in the heart of the city, near the popular Country Malls.

The theme for the seminar was “Strategic Focus of the Commission in the year 2020; from Compliance to Development.”

The seminar was organized by the Nigerian insurance industry regulator, the National Insurance Commission (NAICOM), to update insurance journalists and business editors on the activities of the commission and their plans going forward.

In his keynote address, the Acting Commissioner for insurance, Mr. Olorundare Sunday Thomas, commended the efforts of the journalists for publicizing the activities of the Commission in particular and that of the industry in general and solicited for a sustained mutual working relationship between the journalists, the Commission and the industry just as he charged the journalists to always be objective in their reporting in order to project the image of the industry in a positive way.

According to Thomas, “The Commission as always must commend your contributions and support in the preceding years while also looking forward to a better working relationship and continuous collaboration with you on a sustainable basis. Your efforts in reporting the initiatives of the Commission and other information that have impacted positively on the image of the insurance industry is commended and well appreciated.”

In reviewing year 2019, the Acting NAICOM boss said, “The year 2019 obviously had its low and high moments, benefits and turbulences. Apparently, we all experienced its positive and negative consequences, leaving us with the bitter-sweet lessons that will ultimately shape our decision making in this and subsequent years.”

He said the theme for the seminar “Strategic Focus of the Commission in the year 2020; from Compliance to Development” is apt and timely as the Commission is shifting focus from compliance issues to emphasise more on its market developmental responsibility.

Thomas said as the Year 2020 continues to unfold, giant strides will be made by the Commission in all aspects of its statutory responsibilities, positing that “this is the time to put the past behind us and look forward to a better and more vibrant sector.”

He reminded the industry stakeholders that “the task of building an insurance sector of our dreams is a collective one and thus, all hands must be on deck to ensure our dreams become realities.”

He added, “We recognise the impact of conducive work environment to effective and efficient regulatory system and this will always remain our priority.”

NAICOM boss said that the second phase of the Market Development and Restructuring Initiative (MDRI) will soon be unveiled and it will mark out clear targets and tasks for all stakeholders in the industry.

He said going forward, the Commission shall vigorously pursue the continued implementation of Compulsory Insurances in every nook and crannies of the Country.

According to him, “We are certainly not unaware of the challenges inhibiting the successful implementation of these classes of insurance thus far hence, our resolve to work with relevant stakeholders to ensure a seamless drive.

“Indeed, the successful implementation of compulsory classes of insurance across the nation will ensure adequate protection of our strategic National Assets. We will be working with the relevant security agencies to guarantee effective and efficient monitoring of compliance,” he stated.

On the ongoing recapitalization exercise, Thomas said that the initiative to recapitalise the insurance sector is no longer news, noting that the essence of the recapitalisation is a move to ensure that the industry becomes more robust in its technical competence and financial base, building confidence, trust and enhancing market value.

Recapitalization, according to him, is aimed at repositioning the sector for self-actualization in terms of growth and development, stating that the recapitalization process is up and running in line with the roadmap and the Commission will see to its logical conclusion come December 31, 2020.

Thomas said that the financial inclusion strategy has been central to the Federal Government developmental plan and the Commission has over the years invested hugely in the development of financial inclusion mechanisms which includes the introduction of Microinsurance and Takaful Insurance products.

The introduction of these lines of insurance, he said, is intended to deepen the penetration of insurance in the country and bring into the fold majority of the populace that are hitherto excluded.

“So far, some milestones have been recorded in this regard with three standalone Microinsurance and four Takaful insurance companies already granted approvals.

“The Commission shall continue to deploy more energy and resources in building public trust and confidence in insurance despite years of poor perception. In this regards, your optimum support is required as whatever you write or report about the industry will go a long way in building or destroying the fragile image of the sector. I will therefore implore you to carryout thorough investigation before writing or reporting any contentious issue about the sector. You are all professionals and we have so much respect for you in that regard,” he posited.

On annuity business, NAICOM boss informed the gathering that the annuity business made headlines recently with a boost in the contribution of the business to the sector, adding that the public is becoming more exposed and knowledgeable about the workings of Annuity even as he said that the future of annuity business is looking very bright for the business which he said has also shown a positive growth in trust and confidence in the sector.

Thomas assured of the Commission’s commitment to ensuring financial soundness and viability of the insurers and the adequate protection of policyholders at all times, stating that these will continue to be part of NAICOM regulatory priorities.

“We will continue to ensure that genuine claims are promptly paid while also ensuring a reasonable protection of investments of shareholders.

“In demonstrating its willingness to protect the policyholders, the Commission has further strengthened its Complaint Bureau Unit to respond to public complaints over claims settlement. Available statistics have shown that there have been great improvement in this area.

“Ensuring the right pricing of insurance products and effective deployment of technology for ease of transaction are among the key areas the Commission will be emphasising this year. Digitalisation of insurance business is no longer an option, but an imperative which we all have to work towards its actualisation.

“As we may all be aware, the industry is currently lagging behind other financial services sectors in this area. The Commission is working vigorously to see that all its operations are digitalised. The year 2020 is a year for us to turnaround the fortunes of the industry and this cannot be accomplished without digitalising our processes and encouraging the industry to imbibe same.

“The Commission shall in the course of the year continue to introduce new reforms and initiatives in line with international best practices for attaining the level of growth and development we all desire for the sector, Thomas said.

The theme paper presenter, Deputy Director/Head Research, Statistics and Strategy Directorate, Adewale Motajo, gave details on the Commission’s strategic plans for 2020 and its 2019 scorecard.

He said the Commission’s strategic focus in 2020 is guided by internal and external factors impacting its operating environment, aligned with developmental priorities of the Federal Government.

He said the Commission will continue to give attention to recapitalization of insurance and reinsurance companies; effective administration of Retiree Life Annuity and Group Life Assurance; Market Conduct Guideline; International Financial Reporting Standard (IFRS 17).

Other NAICOM’s focus in 2020 are: Launch of the NAICOM Portal; Risk Based Supervision (RBS); Regional Integration; development of Agricultural Index Insurance; market development ; Actuarial Capacity Development; Financial Inclusion (Micro-insurance); Financial Inclusion (Takaful); Bancassurance Authorization and AML/CFT.

On the Commission’s achievement in 2019, according Motajo included issuance of circular on new Minimum Paid-up Share Capital; Financial Inclusion Initiatives: Approval for: (a.) two Micro-insurance companies and (b) Two new Takaful companies; Championed West African Regional Integration; Finalized the Code of Corporate Governance (adaptation of the National Code).

Others included Awareness Creation on: (a.) FIRS 17 ahead of its commencement in 2022.(b.) Corporate Governance and compliance for insurance Companies Boards of Directors (c.Index-based Agricultural Insurance for AAISA members (d.) Oil & Gas for Loss Adjusters; Stakeholders Engagement: Interactive sessions with (a.) Major Consumers of Insurance Products (b.) Shareholders Associations; Collaborations with : (a.) Joint Committee of NAICOM/PenCom on Retiree Life Annuity. (b.) Discussions with CBN and NCC on Alternative Distribution Channels; (c. )Discussions with other SROs on palliatives for Insurance Companies on recapitalization; Capacity Building in respect of AML/CFT compliance drive training organized for insurers and Assistance provided to four (4) Tertiary Institutions in aid of insurance education.

In conclusion, Motajo said the agenda-setting role of the media makes it a formidable ally to have for any social engineering efforts to succeed and called on the continued support of f journalists to the efforts of NAICOM towards engendering the emergence of financially-sound insurance institutions with capacity to bear risks across all sectors of the Nigerian economy, and aid the realization of Government’s social and financial inclusion goals.