Insurance is Oxygen for Wealth Creation, Protects Factors of Production- Experts

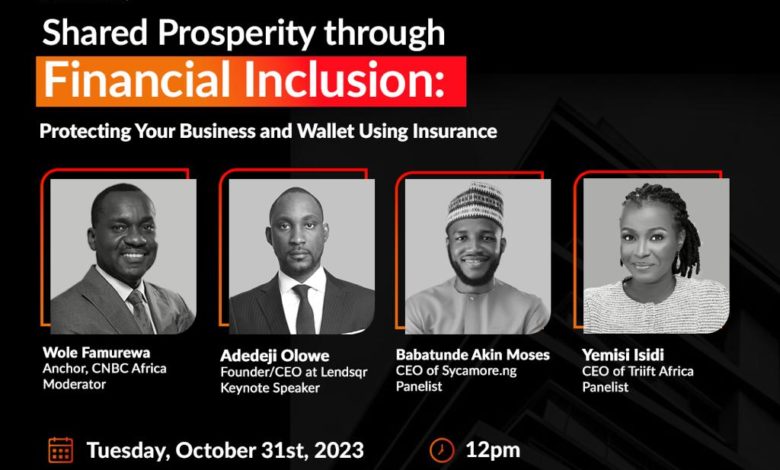

Experts who spoke this afternoon during the Coronation Insurance Webinar series on the theme “Shared Prosperity through Financial Inclusion: Protecting Your Business,” said insurance is the oxygen for wealth creation as well as provides protection for factors of production.

The experts who highlighted the importance of insurance in enhancing financial inclusion also encouraged Nigerian businessmen and women to take insurance to hedge against uncertainties.

They also called on insurance operators to work together to reposition the industry to meet its obligation to the people, especially in their product offering, and service delivery.

Experts who spoke at the event included Mr. Adedeji Olowe – Founder/CEO at Lendsqr (Keynote Speaker); Mr. Babatunde Akin Moses – CEO of Sycamore.ng; Mrs. Yemisi Isidi – CEO of Triift Africa.

According to the keynote speaker, Mr. Olowe, Insurance helps you to handle uncertainties. Insurance is what makes you continue to be alive when forces of life come to hit you for example if you fall sick, or your car gets bashed on the road because of the recklessness of other road users.

He said the poor people are those who need insurance more than the wealthy people.

“What insurance does is to protect your business. It gives you the ability to create wealth. For instance, if you are an Uber driver and you don’t have car insurance, if your car has a problem, maybe the only thing you have is a Third Party; it means that you need to first find money to fix that car. It means that during this period your ability to earn money with that car is taken away,” Adedeji added.

For Businessmen and women, he emphasized the need for them to have the necessary insurances to provide protection for their businesses.

He said insurance will not only save them from uncertainties but also ensure the sustainability of their businesses.

“Insurance actually protects what we call the factors of production. If you are a professional – a Lawyer or an Accountant you need to buy Professional indemnity because professionals are human beings and they can also make mistakes and sometimes these mistakes can cause a lot of problems. What professional indemnity does is to protect you and whenever there is a problem; insurance will come in to handle the damages and claims that might be laid against your business.

He said “Without insurance, whether you are a professional or an artisan, you cannot build a sustainable lifestyle. Insurance is the oxygen for building wealth. It gives you the foundation to handle risk. For example, if you are a businessman and you want to do a major contract, you must have insurance to be able to get the contract.”

On the relationship between insurance and financial inclusion, Adedeji said the two work hand in hand.

“Today we know full well that lack of education and financial inclusion goes hand in hand. It doesn’t mean that if you are not educated you will be poor; neither does it mean that if you are educated you will be rich. It happens that those who are not educated don’t make good decisions that end up making them to be poor, the same thing with insurance and financial inclusion. Insurance is part and parcel of financial inclusion. Those who are educated have insurance because they understand what this means for them.

“Without insurance, there can never be financial inclusion anywhere… insurance, lending and credit are tied together,” Adedeji said.

On why insurance is not everywhere, he called on insurance operators to change the narrative, especially for the financially excluded. “You have to show and not tell. Nigerians, we are difficult people and the only way to convince a Nigerian is to show and not preach. We need to show the people why insurance is the best thing they should have. We have to show them with empathy. We have to show them with commitment and we have to show them consistently.

He said having HMO for your staff means that when they are sick, they will have access to medical care, noting that from a human mental capacity point of view, insurance ensures that you are alive.

Contributing to the discussions, the Managing Director/Chief Executive Officer of Coronation Insurance Plc, Mr. Olamide Olajolo, emphasized the importance of Insurance in wealth creation and national economic growth.

He called on Nigerians to embrace insurance in order to enjoy the numerous benefits it provides.

The Coronation Insurance Webinar Series is part of the Company’s thought leadership initiatives, designed to provide relevant insights for both corporate and individual clients.

This year’s edition of the series, which focused on “shared prosperity through financial inclusion”, also emphasized how insurance elevated the standard of living in Nigeria through economic growth and equity.

The event educated participants on the cost-saving benefits of insurance through risk reduction, using case studies. It also emphasized the ease of purchasing insurance products and how insurance can create income opportunities for agents, both full-time and part-time.