Highlighting Some NAICOM’s Key Achievements In 2022

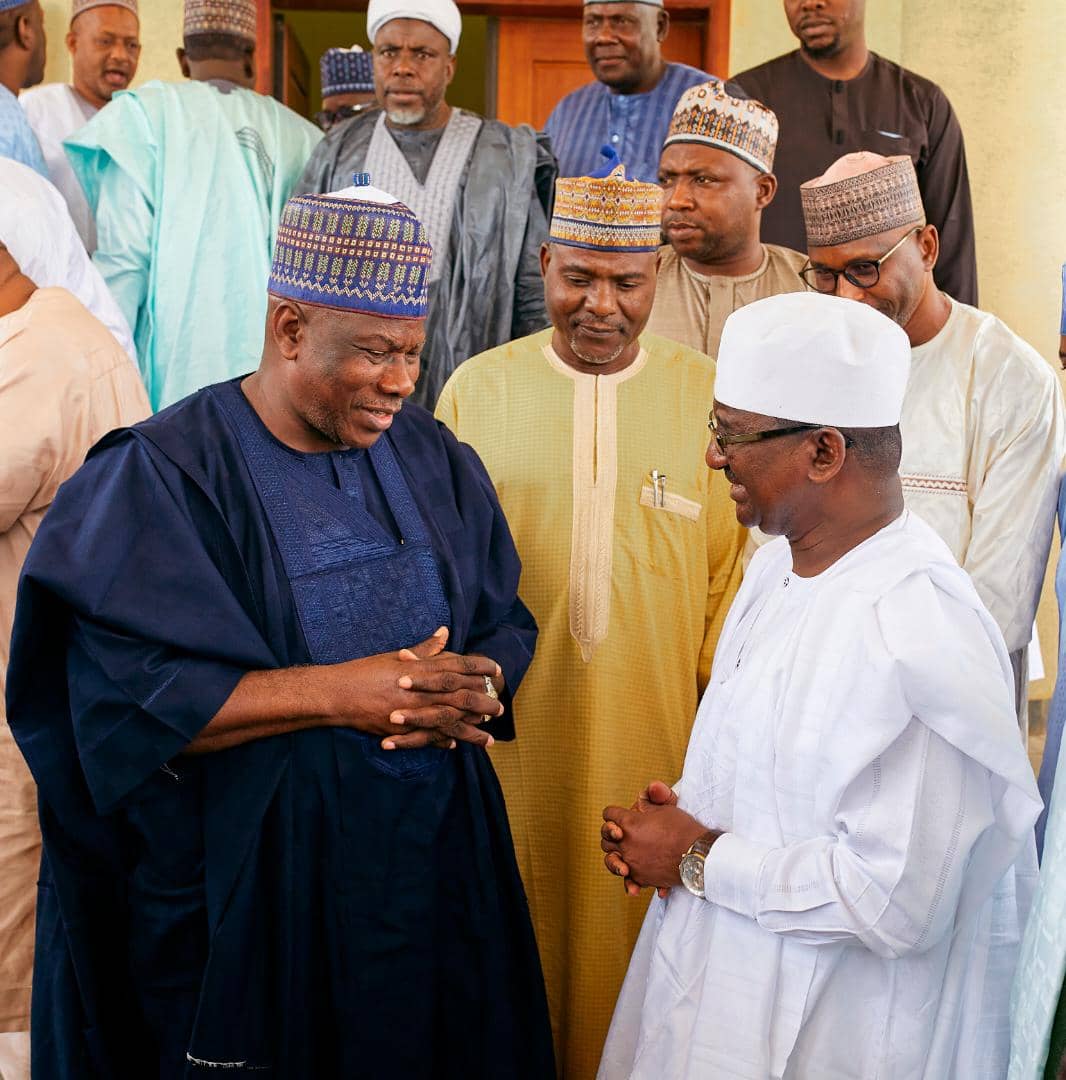

Mr. Olorundare Sunday Thomas, Commissioner for Insurance/CEO, NAICOM

By Edet Udoh

The National Insurance Commission (NAICOM), the Nigerian insurance industry’s primary regulator, has continued to drive the growth of the industry through the implementation of sustainable initiatives.

The Commission was established in 1997 by the National Insurance Commission Act 1997 with the responsibility for ensuring the effective administration, supervision, regulation and control of insurance business in Nigeria and the protection of insurance policyholders, beneficiaries and third parties to insurance contracts.

The mandate of the Commission as specified in the enabling law (NAICOM Act 1997) includes amongst others the establishment of standards for the conduct of insurance business in Nigeria; to approve rates of insurance premiums to be paid in respect of all classes of insurance business; ensure adequate protection of strategic Government assets and other properties; regulate transactions between insurers and reinsurers in Nigeria and those outside Nigeria; act as adviser to the Federal Government on all insurance related matters; approves standards, conditions and warranties applicable to all classes of insurance business and protect insurance policyholders, beneficiaries and third parties to insurance contracts.

Others are: publish for sale and distribution to the public, annual reports and statistics of the insurance industry; liaise with and advise Federal Ministries, Extra Ministerial Departments, statutory bodies and other Government Agencies on all matters relating to insurance contained in any technical agreements to which Nigeria is a signatory; contribute to the educational programmes of the Chartered Insurance Institute of Nigeria and West African Insurance Institute, and Carry out other such activities connected or incidental to its other functions under the Act.

Over the years, the Commission has continued to perform its statutory functions and the mandates it was established to carry out toward ensuring the growth of the industry.

This article focuses only on the implementation of some key initiatives and achievements of the Commission in 2022.

Early enough this year, in February, to be precise, the Commission issued the “Insurance Web Aggregators Operational Guidelines” which serves as a working document to register, supervise and monitor web aggregators as Intermediaries who provide information on products of different Insurers

In order to promote Financial Inclusion and access to insurance in Nigeria, the Commission launched the BimaLab Nigeria project in partnership with Financial Sector Deepening Africa (FSD Africa) which is aimed at coaching and mentoring Insurtech firms, granting funds in developing innovative business solutions focused on solving compelling economic or social problems as well as bringing commercial value to the insurance industry.

In March this year, the Commission launched the R3Lab Platform which will assist regulators and supervisors in Africa to work together to strengthen their methodologies and develop solutions necessary to create an enabling regulatory environment.

In May 2022, NAICOM and FSD Africa organized the “BimaLab Insurtech Demo-day” which allowed cohort members to pitch their solutions to potential partners, industry stakeholders, and investors to create visibility and opportunity to secure funding for their businesses.

A total of 10 start-ups that participated in a ten-week accelerator program were showcased at the Demo-day event and the cohorts in the BimaLab project have obtained requisite regulatory approval to roll out its products in collaboration with an insurance company. Other cohorts who participated in the BimaLab project are working to roll out their innovative products.

In addition to these, the Commission is implementing a Legal and Regulatory Framework (Regulating for Innovation) designed to develop a framework for sustainable innovation in the Nigerian insurance industry in fulfilment of the Commission’s dual objectives of market development and protection.

Another very pivotal project currently being implemented by the Commission is the Risk-Based Capital (RBC) project which is intended to provide a clear set of policy plan for full implementation of RBC framework including the key steps, frameworks, and tools required for RBC implementation. The project is nearing completion with the conclusion of working sessions on the proposed RBC tools.

It is important to also state that the Commission’s market development and restructuring initiative which, amongst others, will facilitate enforcement of compulsory insurance is part of efforts to increase insurance penetration, improve access to insurances, and sensitize the polity on the benefits of insurance. Some of the activities implemented thus far include under the initiative are: licensing of additional inclusive insurance providers for the excluded and/or low-income segment of the Nigerian population; awareness creation and learning sessions carried out on Microinsurance and Takaful insurance; Engagement and sensitization forum for Federal & State Fire Service Officers, Federal Road Safety Corp, Vehicle Inspection Officers, etc.

Others include engagement with the Government of Kano and Katsina State on compulsory insurance; interactive sessions with major stakeholders of the Nigerian Insurance Industry to facilitate better understanding of the concerns, views, and challenges of stakeholders of the industry and implementation of Risk Based Supervision exercise, among many others.

The Commission on May 25, 2022, inaugurated the Nigerian Insurance Industry Committee on African Continental Free Trade Area (AfCFTA).

On June 8, 2022, the Commission, in partnership with the Nigerian Content Development and Monitoring Board (NCDMB) officially launched and unveiled Guidelines on Submission of insurance programme by operators, project promoters, alliance partners and indigenous companies in the Nigerian oil and gas industry.

On June 23, 2022, NAICOM organized a sensitization workshop for the Joint Taskforce on Enforcement of Compulsory Insurance in the Federal Capital Territory (FCT) as a Pilot Scheme. The workshop was aimed at sensitizing members of the Taskforce on the requirements of the law with respect to the compulsory insurances as well as the enforcement modalities to be adopted by the task force committee. The task force comprises the Nigerian Police Force, the Federal Road Safety Corp, the Federal Fire Service, FCT Fire Service, Vehicle Inspection Officer, the Office of the Attorney General of the Federation and the Federal Capital Territory Administration.

Within the period under review, the Commission has visited the Minister of the Federal Capital Territory, Mohammed Musa Bello as well as the Secretary to the Federation, Boss Mustapha where they discussed the need to work together for the growth of the country. It has also ensure proper consultations with operators, intermediaries and other relevant stakeholders in the industry.

On September 29, 2022, NAICOM visited Edo State Government to educate the people of the state on the Commission’s activities including the insurance market development initiatives and the enforcement of compulsory insurance.

The Commission is also doing everything within its powers in revolutionizing the industry, ensuring that the industry operators adopt and embrace technology in their operations and processes as well as meet its contractual obligations, especially in the area of claims payment.

The Commission in trying to restore sanity in the industry has adopted a name and shame policy. The strategy would, among other things, deter bad behaviour among operators in the industry.

The chief executives of all insurance companies in the country had agreed to the policy which would have names of defaulting operators publicised to keep them “away from doing bad.”

As a result of these, the regulator had been able to restore some measure of consumer confidence in the industry through recent policy initiatives including an outright directive to settle all legitimate claims.

Speaking at the 2022 Insurance Professionals’ Forum held at Abeokuta, Ogun State, the Commissioner for Insurance and Chief Executive Officer of NAICOM, Mr. Olorundare Sunday Thomas, highlighted the activities and achievements of the industry and the direction it is heading as well as what the operators must do.

According to him, insurance practice in Nigeria in the past has had its good, bad and ugly moments. One of such bad and ugly moments that have had a significant impact on the image and perception of our industry is the issue of claims payment.

“Indeed the records and statistics of unpaid claims associated with some of our members have not been too good and must be overturned to the benefit of all stakeholders. I must quickly acknowledge and salute the efforts of those companies that are alert to their responsibility of prompt claims payment and encourage them to sustain the good practice.

“Insurance practitioners must be seen to be fighting this cause genuinely and collectively for the future of insurance to be as bright as we expect it. We must not continue to harbour elements of destruction under our roofs. The issue of non-payment of genuine claims has always put the Commission and the entire industry on the defensive when it comes to discussing insurance in every stratum of the economy. I must tell you that the Commission is doing all it could within the ambit of extant laws to see that the non-settlement of genuine claims is eliminated in the sector and I can assure you that we will not relent,” he advised.

Thomas admonished “all to leverage the positive experiences from the past to build a formidable future for insurance in Nigeria. The effort must be collective and patriotic.

“We must all see insurance as a profession that should be a buffer for the economy while eliminating the toga of being the weak link within the financial services sector. We must practice insurance with passion and resilience not just as a means of livelihood that we have to survive on but, that which every insurance professional should be proud to say “I am a party to this success.”

He said the long-standing issues on ethical behaviour in the industry can be said to have significantly improved over time just as he urged operators to bequeath young professionals eager to join the noble insurance profession a good legacy to emulate, adding that the integrity of the insurance business depends solely on the level of integrity we display as professionals in the business.

He said the image and future of the insurance business in Nigeria depends majorly on “how we uphold and encourage members to adhere strictly to the observance of the industry’s codes of conduct and ethics.”

He said the Commission’s portal has been launched and effectively deployed, noting that Innovation will be the key to the sustenance of the industry and make insurance services seamless by leveraging technology which drives applications like Insurtech, FinTech, blockchain, data analytics, Internet of Things (IoTs), etc.

While enjoining all to work together to explore all possible means to take insurance to a new level to enhance the industry’s contribution to the nation’s economy, Thomas said “With respect to the efforts of the Commission in the area of regulation and supervision of the market, the Commission embarked on innovative regulations, policies, guidelines and programs aimed at restructuring for the future of the Nigerian Insurance Industry.”

The first phase (Module I) of the Commission’s migration from analogue to the digitalization of its core processes (execution of Project e-regulation), the NAICOM boss said, has been completed.

Also speaking at the commissioning of the NAICOM Portal, the Commissioner for Insurance said the portal provides a Platform for interconnectivity by all industry stakeholders to support real-time aggregation of data on policies at the time of underwriting and policy issuance.

He said each policy is issued with a unique policy ID associated with the policy for the life time of the policy, adding that the Portal is presently made up of four systems namely: The Policy System; Licensing System; Complaints Management System and Regulatory Returns and Financial Analysis.

The Policy System, according to him, captures all insurance policies issued in Nigeria online real-time via Application Programming Interface (APIs) and generates a unique policy identification number for all issued policies necessary to ensure fidelity and validity of all policies in the country and manages information on all insurance policies and premiums as well as enables insurance customers and third-party entities such as Law Enforcement Agencies to query and validate insurance policies.

“The Licensing System automates the core business processes of Registration/Renewal of Licenses, New Products, AIP no objection & Attestation approvals at NAICOM. All of these application processes will proceed digitally from the application stage where all supporting documents are provided, to the review stage, the approval stage and license generation where applicable.

“The Complaints Management System is a customized solution designed to help the Commission manage complaints and handle issues seamlessly as well as ensure that insurance companies are performing highly and clients are serviced adequately. The system is also designed to integrate directly with NAICOM existing database, utilizing existing records of customers and insurance companies; it incorporates multiple channels for initiation of complaints including Social media applications (Facebook, WhatsApp, Instagram, and Twitter), Direct action on the complaint portal, Walk-in complainants, Regular media, Emails &SMS (Short Code) and Unstructured Supplementary Service Data (USSD), he added.

While the Regulatory Returns and Financial Analysis, Thomas said, provides the platform for the submission of all Insurance Industry Regulatory returns and compliance electronically. The financial analysis module of it aims at automating the financial analysis, credit control functions, computation of levies, and providing adequate and timely information to support management decision-making as well as serve as a central repository for current and historical financial information about the Insurers, Re-insurers, Brokers and Loss Adjusters.

Thomas described the launch of the portal as a welcome development and further demonstration of commitment by development partners to the transformation of the Nigerian economy and the change agenda of the current administration under the leadership of His Excellency, President Muhammadu Buhari.

The Honourable Minister of Finance, Budget and Planning, Mrs (Dr) Zainab Shamsuna Ahmed, speaking at the commissioning of the NAICOM portal, said the commissioning of the Portal should serve as a springboard for industry-wide adoption of technology and innovation for efficient and effective service delivery, ease of transacting business and customer experience and satisfaction, positing that the industry should provide quick turnaround time on their services, grant access to information when required without any inhibitions and maintain effective real-time communication with its customers.

She said the dwindling Government revenue profile demands that the Commission must look into ways of increasing its revenue through the use of technology and the Portal in particular.

She urged the Commission to ensure the Portal is connected to other government databases like the National Identity Management Commission (NIMC) NIN Database, Nigeria Immigration Service (NIS) Passport Database, Nigeria Integrated Customs Information system, FRSC’s National Vehicle Identification System, the National Vehicle Registry, State Licensing Databases among others in order to provide value-added services to all Insurance Industry stakeholders and enhance revenue generation.

She called on the Commission to ensure that the Portal serves as the central database and sole repository of all Insurance Data connected to government databases in the country, noting that the unsatisfactory response to the settlement of claims by underwriters had greatly contributed to the prevailing poor public perception and lack of trust and confidence in the insurance Industry.

“Indeed, prompt claims payment is the best advertisement for the industry, therefore all genuine claims that have been duly verified and due process followed should be paid promptly.

“The Commission must put in place mechanisms to ensure Insurance companies meet their obligations to policyholders by paying claims promptly as that is the major reason they exist in the first place. Claims payment determines the valuable structure of the industry in the economy.

“The current Insurance Penetration, a measure of the contribution of Insurance to the Gross Domestic Product (GDP) of 0.88 for 2021 is very low. This indicates a low Insurance sector development contribution to the National Economy. However, this also shows that there are abounding opportunities for growth in the market. There is a need, therefore, to develop new innovative products based on data and customer preferences and introduction of new channels of distribution beyond the traditional channels to reach new segments of the market.

“There is also a need for cooperation with other agencies of government to enforce compulsory insurances in the country. Stakeholders in the industry must consciously and intentionally spread the reach of insurance from the major cities and a few states to other regions of the country, especially the rural areas. Low penetration in the retail end of the market must also be addressed through the vigorous drive of inclusive Insurance like micro-insurance and Takaful,” the Finance Minister said.