Health Insurance, Retirement Savings, Others As Right Benefits Package For Employees

Findings have shown that today employees are interested in the total benefits package they are receiving from their employers, and one of the benefits they are expecting most in the benefits package is Health Insurance.

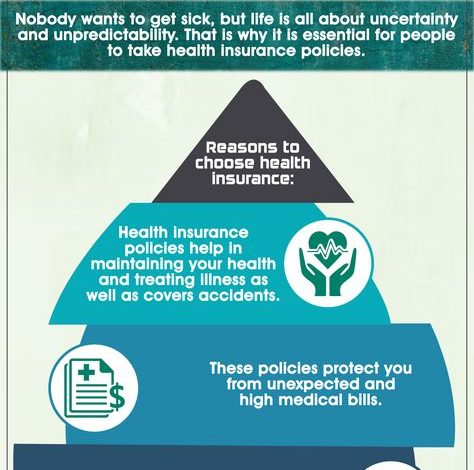

Health insurance is a type of insurance that covers medical expenses that arise due to an illness. These expenses could be related to hospitalisation costs, cost of medicines or doctor consultation fees.

According to Gregg Schoenberg in his article “The Benefits of Benefits” published on DelawareInc.com, as you build a business and hire employees, you are often faced with decisions about which benefits to provide for your staff. With so many options to choose from—from health insurance to retirement savings to profit-sharing and stock-option plans—picking the right package of benefits to keep your employees happy and your business profitable can seem like a daunting task. But a few recent studies help to shed some light on which benefits employees value most, and some of the results might surprise you.

He said “While we’re all familiar with the maxim, “cash is king” but when it comes to employee benefits it seems that this old adage does not ring true. A study conducted by Sun Life Financial found that employees valued their total benefits package more than the cash component of their salaries. And MetLife’s annual Study of Employee Benefits Trends revealed that employees place more value than ever on their benefits, even if they have to fully pay for those benefits themselves.”

These findings, he said, “could have a profound impact on the way that entrepreneurs think about compensating their employees. While many of us may eschew providing a generous benefits package because it is too expensive, and choose to pay employees a more competitive salary instead, this appears to be the wrong approach. Instead, it may make more sense to offer staff a lower salary, in addition to a suite of benefits, while having the employees contribute to some, or even all, of the cost of the benefits package.

“As far as which benefits employees value the most, the results of both studies—as well as a survey conducted by the Principal Financial Group—point to a clear winner: health insurance. (Did you notice all three surveys were done by insurance companies?) Given the peace of mind that comes from being insured, and the high cost of obtaining insurance on your own, this shouldn’t come as a great surprise.

“But what many of us may not have expected are the two categories that ranked at the bottom of employees’ wish lists: profit sharing/bonus plans and stock options. These results show once again that the vast majority of people prefer to receive benefits that increase their sense of security, as opposed to those that could increase their purchasing power and the balance in their bank account,” Gregg Schoenberg explained.

He said “When it comes to financial benefits, “Defined Contribution Plans” such as 401(k)s, where employees contribute their own money (sometimes matched by employers), actually rank much higher than “Defined Benefit Plans”, where the employer shoulders the cost.

“While we’d all like to provide our loyal employees with an extremely generous set of benefits, in the world of small business that’s not always fiscally possible, or financially responsible. But by understanding which benefits your employees are most likely to find valuable, you can provide them with the satisfaction and security they are looking for, and maybe even improve your company’s bottom line at the same time,” he added.

According to Forbes Advisor, Employees will always take more money if you offer it. But pay alone isn’t necessarily all it takes to attract and keep good employees.

In a survey of employed workers and employers, Forbes Advisor found that over 80% of employees older than 42 are looking for roles that include employer-covered healthcare.

The survey also discovered that 40% of employers say workers leave their job to find a role that offers better employee benefits.

The survey also found that 62% of businesses have changed their benefit offerings in the past year.

“Forty percent of employers say they believe workers leave their job to find employment that offers better benefits.

“More than half of American workers (54%) report being content with the benefits their current employer offers.

“One in 10 workers would take a pay cut to have access to better benefits that includes Health Insurance.

“Over 30% of 18–41-year-olds are most concerned with having pet insurance available as a benefit.

“Nearly 40% of 42–57-year-olds are most likely to want mandatory paid time off from their employer,” Forbes Advisor stated