Guaranty Trust Holding Company Profit Hits N1Trn In Six Months

Guaranty Trust Holding Company Plc has released its interim consolidated and separate financial report for the half year ended June 30, 2024.

The report shows that the bank grew its profit before by 206.36 per cent to N1.003trn from N327.39bn during the comparable period last year.

The bank accomplished this despite soaring inflation. Though the latest inflation report released by the National Bureau of Statistics (NBS) showed Nigeria’s headline inflation rate decreased to 33.40 per cent in July 2024, down from 34.19 per cent in June 2024, the country’s inflation still remain elevated.

Key extracts of the audited report and accounts of GTCO for the six-month period ended June 30, 2024 released to the Nigerian Exchange (NGX) and London Stock Exchange (LSE) yesterday indicated three-digit growths across key performance indicators.

Gross earnings rose by 106.95 per cent in six months to N1.39trn from N672.6bn during the comparable period last year.

During the period under review, the Board of Directors proposed the payment of an interim dividend in the sum of N1.00K per ordinary share on the issued capital of 29,431,179,224 ordinary shares of 50 Kobo each.

Group profit before tax rose by 206.6 per cent from N327.4 billion in first half 2023 to N1.004 trillion in first half 2024. Profit after tax leapt from N280.48 billion to N905.57 billion. The bottom-line performance was driven by significant expansion in group’s businesses, especially a major uptick in returns from the group’s flagship subsidiary, GTBank Nigeria Limited.

Net interest income rose from N177.46 billion in first half 2023 to N491.51 billion in first half 2024. Net fee and commission income doubled from N51.55 billion to N101.07 billion. Other incomes doubled from N372.22 billion to N630.27 billion, a major boost to the overall group performance. GTCO explained that “other income of the holding company…is purely dividend income received from GTBank Nigeria Ltd”.

The bottom-line was also strengthened by significant decline in net impairment charges on other financial assets, which dropped from N81.31 billion in first half 2023 to N357.55 million in first half 2024.

The group’s balance sheet also emerged stronger. Group net loan book increased by 25.5 per cent from N2.48 trillion recorded by the year ended December 31, 2023 to N3.11 trillion by June 2024. Deposit liabilities grew by 39.8 per cent from N7.55 trillion in December 2023 to N10.55 trillion in June 2024.

The report showed that the group recorded growth across all its asset lines, maintaining a well-structured, healthy, and diversified balance sheet across all jurisdictions wherein it operates. Performances across payments, pension and funds management business segments improved considerably, resulting in total assets and shareholders’ funds of N14.5 trillion and N2.4 trillion respectively.

Regulatory ratios remained strong with Capital Adequacy Ratio (CAR) of 21.0 per cent. Asset quality was sustained as evidenced by IFRS 9 Stage 3 Loans which closed at 4.3 per cent in June 2024 from 4.2 per cent in December 2023.

Cost of Risk (COR) improved to 1.6 per cent in June 2024 from 4.5 per cent in December 2023. Pre-tax return on equity (ROAE) stood at 103.6 per cent while pre-tax return on assets (ROAA) closed at 16.6 per cent.

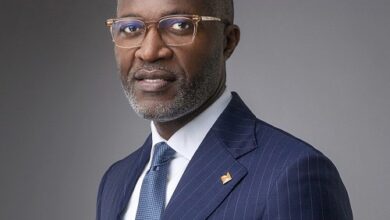

Group Chief Executive Officer, Guaranty Trust Holding Company (GTCO) Plc, Mr. Segun Agbaje, said the first half performance underlined the resilience of the group, despite global and national challenges.

“We are immensely proud of the progress we have made as a leading financial holding company. Despite the uncertainties in the operating environment, our performance in the first half of the year, where we recorded our highest profit to date, is a testament to the resilience and adaptability of our business model.

“We remain optimistic about the future and are committed to leveraging our unique strengths as a thriving financial services ecosystem to create sustainable value for all our stakeholders as we continue to position all our business verticals–banking, funds management, pension, and payments–for rapid growth across key markets,” Agbaje said.