COVID-19 has revealed importance of insurance – Anchor Insurance boss

Mr. Ebose Augustine Osegha, MD/CEO, Anchor Insurance

The Managing Director/Chief Executive Officer, Anchor Insurance Company Limited, Mr. Ebose Augustine Osegha, has said insurance all over the world remains risk mitigating mechanism and called on Nigerians to see what COVID-19 pandemic has done to businesses, human lives and economies generally all over the world to embrace insurance.

Ebose explained that the impact of COVID-19 has created deeper awareness for insurance, noting that it has made most people who had before now regarded insurance as a “yahoo yahoo business” to come to terms with the importance of risk coverage.

He expressed optimism that with everyone now knowing the damage which situations like this could cause to businesses, economy and human lives, more people were likely to embrace insurance when the ongoing Coronavirus pandemic was over in Nigeria.

Mr. Osegha said this in a live telephone interview with Plus TV Africa during the station’s ‘News in Pidgin’ programme on the theme “COVID-19: Impact on Insurance Industry,” recently.

The Anchor Insurance boss who expressed displeasure over government’s nonchalant attitude toward insurance and welfare packages for its workers stated that some state governments have no health insurance, public liability, group personal accident or even group life policy for their staff just as he called on them to learn from the experience so far from COVID-19 to provide the necessary insurance covers for their workforce.

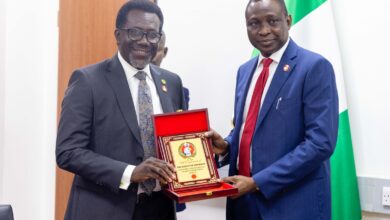

According to him, “early this year when an award was given to Anchor Insurance, I called on government at all levels to brace up for challenges in future by providing insurance for their workforce. It was as if I was talking as a prophet then but now, it has happened.”

According to him, “even the business community is not left out. Before now, most business concerns looked away from taking business interruption covers for their operations. Also, most employees would not see the need to pick the loss of employment insurance covers because there will be job losses after the pandemics. Whatever effects they must be feeling now would have been mitigated if they had picked policies of the types I have mentioned here.”

On claims, Mr. Ebose said the insurance sector was experiencing high ratio but added that with the adequate and necessary reinsurance plans already put in place as well as the insurance reserve, the sector has been up to its task.

On measure put in place to cushion the effect of the pandemic on the industry’s operations, he said they have to cut down on some expenditure and channel their resources to those things that are necessary now.

“Now Information Technology (IT) is taking more money because when you are cutting from one side, you use it to support the other side. Before now, face mask and hand sanitizers were not in our budget but now we have to add them. The need for social distancing has, for instance, made us in Anchor Insurance Company Limited to buy more cars for staff use to avoid getting caught up with the issues that attend to using public transport and to ensure they remain healthy and productive.”