AIO At 50: African Insurers Urged To Secure Better Future For Insurance Industry

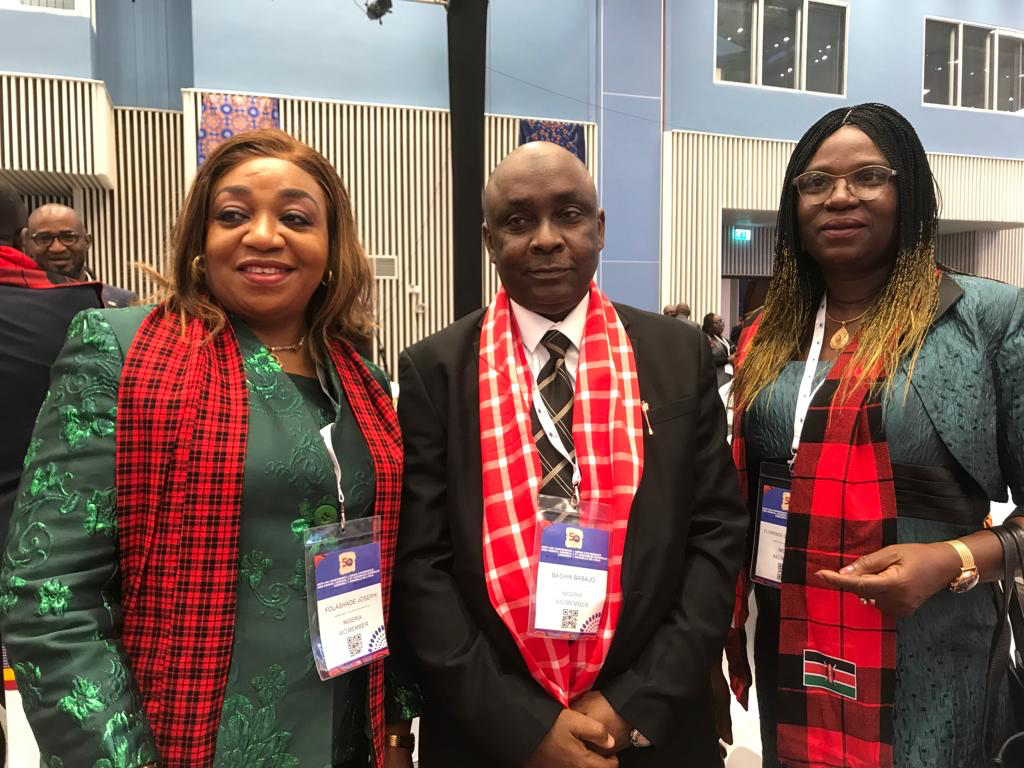

From Left: MD/CEO Nigerian Agricultural Insurance Corporation (NAIC )Folashade Joseph; Executive Director(Operation) Mr. Bashir Babajo and Deputy General Manager (Claims and Reinsurance) Mrs. Florence Onwuanuokwuat the event.(photo: Business Today)

As African Insurance Organization (AIO) clocks 50 years this year, African insurance operators in the continent have been urged to secure a better future for the industry.

They were also enjoined to address the problems of low insurance penetration level, premium flight and poor public image, if they intend to secure a better future for the industry.

Speaking yesterday at the 48th Conference and Annual General Assembly of the AIO in Nairobi, Kenya, Smart who is also the Group Managing Director of Nem Insurance Plc in Nigeria, noted that the African insurers still has a lot to do especially in the area of insurance penetration.

The theme of the conference is “Insurance And Climate Change: Harnessing The Opportunities For Growth In Africa”.

He lamented that the African insurance industry remains one of the least penetrated in the world, with an average of about 2%, which is low compared to the global average of around 7%.

“Our industry’s growth keeps getting slowed down by our inability to build substantial capital reserves due to poor saving culture and “Premium flight”, while “there is still heavy reliance on foreign expertise,” he said.

He added that “Our industry is still plagued by poor public image and lack of trust”, saying “these and many more are the challenges we face today, and we need to address them if we intend to secure a better future for our industry.”

As the AIO clocks 50 this year, he informed that the Golden Jubilee of the organisation will be marked by a symposium, where the operators intend to discuss some of these challenges facing the insurance industry in the continent.

In view of the fact that the African Development Bank posited that Africa is the most vulnerable continent to climate change impacts under all climate scenarios above 1.5 degrees Celsius, he expressed worries that “despite having contributed the least to global warming and having the lowest emissions, Africa faces exponential collateral damage, posing systemic risks to its economies, infrastructure investments, water and food systems, public health, agriculture and livelihoods, threatening to undo its modest development gains and slip into higher levels of extreme poverty”.

As the continent’s risk managers, he called on the insurance sector to provide risk management solutions, in the form of risk mitigation and transfer, building resilience and enabling the continent transition to

I net-zero greenhouse gas emissions. He further urged the insurance operators to strive to always be an enabler and not a barrier to the advancement of the African insurance industry and African development as a whole.

PMeanwhile, the AIO signed a revised Headquarters Agreement with the Cameroonian Government in Yaoundé recently, which now grants the AIO all the merits of an international organisation with accompanying advantages.

Some of the advantages highlighted by the AIO boss include full exemptions from taxes and custom duties, immunities, facilities of staff of the AIO under the Diplomatic Scheme, improved facilities surrounding the keeping and handling of foreign currencies in Cameroon and many more.

He commended the achievement of the CEO of the College of Insurance, Kenya and incoming President of AIO, Dr. Ben Kajwang.

“As we celebrate the AIO 50th Anniversary, I have the pleasure to announce to you that the Edge Hotel and Convention Centre where we are seated today, the largest state of the art Conference Facility in Nairobi complete with all the other facilities, has been built by the College of Insurance of Kenya and the whole project executed by one of us who has had a visionary leadership, strategic thinking, commitment, focus, passion and drive for its successful completion; and that is none other than the CEO of the College of Insurance and incoming President of AIO, Dr. Ben Kajwang.

Let me request him to come forward for a “standing ovation” from the Insurance fraternity from the African Continent and the rest of the World.”