Access Holdings extends deadline for N351b rights issue to August 23, 2024

Access Bank has extended the acceptance deadline for its ongoing N351 billion rights issue, providing existing shareholders and other investors additional opportunity to participate in the new capital raising.

Access Holdings is offering 17.772 billion ordinary shares of 50 kobo each to existing shareholders at N19.75 per share. The offer opened on Monday, July 08, 2024.

The offer period, which was initially scheduled to close on August 14, 2024, has now been extended to August 23, 2024. The extension followed approval of the Securities & Exchange Commission (SEC).

In a regulatory filing at the Nigerian Exchange (NGX), Access Holdings explained that the decision to extend was in response to the recent nationwide protest that disrupted operations of businesses and individuals across Nigeria.

The group stated that the extension also provides shareholders with ample opportunity to subscribe to their rights.

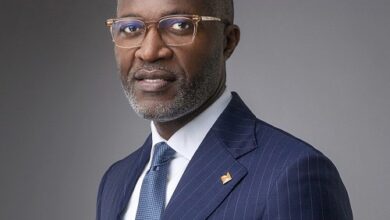

Chairman, Access Holdings Plc, Aigboje Aig-Imoukhuede, has said the group decided on a rights issue as a commitment to the bond between the group and its shareholders.

According to him, shareholders’ value was at the core of the group’s business vision and the group decided shareholders who had endured to build the group to its enviable status should reap the benefits.

At the “Facts Behind the Rights Issue” session at the NGX, Aig-Imoukhuede said the group is moving to a new phase of its phenomenal growth where shareholders would reap bountiful returns on their investments.

He urged shareholders to pick their rights as they stand to gain more from their investments.

According to him, the additional capital will enable the group to maximise emerging opportunities and deliver long-term value to shareholders.

He said the group is committed to strengthening ties with shareholders and enhance value creation.

Managing Director, Access Bank, Roosevelt Ogbonna said Access Bank UK is well positioned to become one of the top 20 banks, generating profit of about $1 billion annually.

He said the bank’s presence in this sophisticated market has continued to positions it strategically in the areas of facilitating and enhancing cross-border trade across the globe.

According to him, its resolve to providing innovative financial solution has played a vital role in supporting businesses and investors involved in international trade over the years.

He noted that the bank is currently in its consolidation phase to add value to shareholders investment, having invested heavily in new markets, skills and infrastructure, technology over the last 10 years.

“All our earnings is in the UK dollarised. So it means every time there is a devaluation, our UK business continues to grow, so we have created a natural hedge.

“Going forward, our consolidation with shareholders will be to show what we have built over the years. Our international business is competing with other foreign banks in capitalisation. The institution has indeed delivered in all its commitment from 2002,” Ogbonna said.