NAICOM to offer regulatory forbearance for unrecapitalised insurance firms

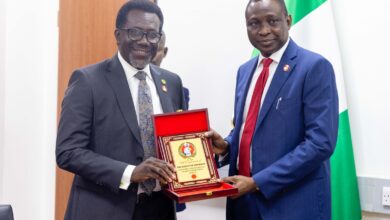

Sunday Thomas, Ag. Commissioner for Insurance

The Acting Commissioner for Insurance, National Insurance Commission (NAICOM), Mr. Sunday Thomas, said the Commission do not want any insurance firm to be liquidated after the ongoing recapitalization, adding that the commission would offer regulatory forbearance which would provide an opportunity for un-recapitalised firms to team up together to enable them remain afloat.

He disclosed this Wednesday at the Chartered Insurance Institute of Nigeria (CIIN) 2020 Business Outlook in Lagos.

Thomas who was speaking on “Recapitalisation & Stability in the Insurance Industry – Role of the Regulator”, noted that the commission would provide an orderly exit for un-recapitalised insurance companies, stressing that liquidation of firms often turns out to be difficult to handle due to issues around it and that it never favours both the regulator and operators.

He posited that the commission will issue guidance note on recapitalisation by the end of March 2020, adding that the commission has observed that some companies are still pursuing businesses that are putting holes in pockets.

He maintained that recapitalisation is really necessary because when the industry is stabilised, it would help stabilised other sectors.

Thomas charged operators to note that the recapitalisation will not lead to more branches in foreign countries that are as big as a local government in Nigeria, stressing that the funds will be used to underwriter big businesses, pay claims and support the economy.

On roles of the commission in the ongoing recapitalisation, he said NAICOM as a regulator would ensure transparency and certainty of the process; orderliness of the recapitalisation process; ensure an enabling environment – palliative and level playing field – fair to all.

Other roles according to him include; ensuring that recapitased companies are liquid; safety of funds raised – Payment into Escrow Account; orderly exit of un-recapitalised companies and efficient resolution of pre and post-recapitalization governance/conflicts.

Thomas maintained that the the commission is committed to sustainable growth in order to enhance the stability of the Insurance Industry in Nigeria.

“We therefore invite the insurance sector to maximize the opportunities inherent in the 2020 Federal Government budget of sustainable growth and job creation whilst also ensuring seamless transition to the new capital regime of the Industry,” he said.

Managing Director/Chief Executive Officer, Excel Professional Services Ltd., Dr. Oladimeji Alo, speaking on “The Nigerian Economy 2020 Issues, Challenges and Prospects for the Insurance Industry” said many of the economics policies and plans for 2020 hold great prospect for growing the economy, promoting job creation and reducing poverty.

He said insurance firms that would do well in 2020 are those who had invested in their brand equity; innovation capabilities; talent management capabilities and information technology resources and capabilities.

Source: Inspenonline.com