Experts Urge Insurance Brokers To Embrace Regulations, Resourceful Leadership

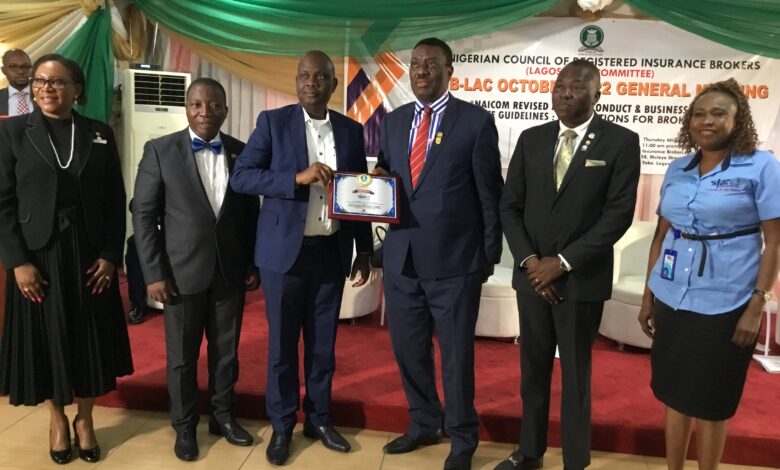

L-R: Mrs. Ekeoma Ezeibe, Vice President, Nigerian Council of Register Insurance Brokers (NCRIB); Mr. Rotimi Olukorede, Chairman, Lagos Area Committee, NCRIB; Mr. Wale Banmore, Managing Director/Chief Executive Officer, STACO Insurance PLC, President/Chairman of Governing Council, NCRIB, Bar. Rotimi Edu, presenting appreciation plaque to MD/CEO of STACO for sponsoring the October edition of the NCRIB Lagos Area Committee’s Monthly General Meeting; Mr. Babatunde Oguntade, Deputy President, NCRIB and Executive Director, Technical, Staco Plc at the October NCRIB LAC Monthly General Meeting held at the NCRIB Secretariat, Alagomeji, Yaba Lagos on Thursday, October 6, 2022.

Members of the Nigerian Council of Registered Insurance Brokers (NCRIB) have been urged to comply with and implement all relevant regulations guiding the broking business operations and practices as will be released to them from time to time by the industry regulator, the National Insurance Commission (NAICOM).

They were also implored as leaders to apply high level of resourcefulness in the management of their resources to ensure growth, profitability and sustainability.

Delivering the theme paper “NAICOM Revised Market Conduct & Business Practice Guidelines: Implications for Brokers at the October edition of the NCRIB Lagos Area Committee Monthly General Meeting, the Vice President, NCRIB, Mrs Ekeoma Ezeibe highlighted the advantages of complying with the Guidelines and the implications for refusing to comply.

Ezeibe who also spoke extensively on the Prudential Guidelines for Insurance Institutions in Nigeria 2022, emphasized the need for members to comply with the regulations for the good of their profession and growth of the industry.

Accordingly, she said, “when you see revised it means that we have had these guidelines in existence, just that they have been revised for the current year, adding that the two Guidelines have come into effect since September 1, 2022.

“The Revised Market Conduct & Business Guidelines for Insurance Institutions in Nigeria 2022 came into effect on September 1, 2022 and therefore, whatever filings we are making now or if we are registering new broking insurance company, we will be guided by the provisions of the Guidelines.

She urged the members to find time to read the Guidelines that it is not meant for pleasure but for our business, and enjoined the members not to get overwhelmed by the content of the Guidelines.

She said the Market Conduct and Business Practice Guidelines was issued by NAICOM on August 18, 2022 through a circular to all insurance institutions in Nigeria.

This Guidelines, according Mrs Ezeibe who is also the Managing Director/CEO, Crystal Trust Insurance Brokers, “are part of the extant roles for regulatory and supervisory work that NAICOM is doing for us and they are to be read in conjunction with Insurance Act 2003 and also other Guidelines, Regulations, Circulars that NAICOM had issued hitherto except where there is any Circular that clashes with this, this one being the latest one, obviously holds sway.

“Often times when these Guidelines are released from the Regulator are meant to keep our operations under check and this makes us to fear them because anybody who has power over your license, over everybody working for you, deserved to be fear and the moment you stop fearing NAICOM, it means all of us are in trouble; it means that our operational environments have been compromised; it means that the faith that the client had to have in us, as people representing them, have been compromised, therefore, we need the regulator even more than they need us because they give us validity to the things we do for our clients, for us and, of course, for the economy generally and when we think of it that way, they will become less fearful.

“The Guidelines are applicable to all insurance institutions and each insurance institution supposed to be serving internal policy and procedures to give effect to the Guidelines and these policies and processes are supposed to form part of our internal control measures,” she explained.

Prudential Guideline, according to her, “is the Guideline to make sure that we are cautious, and careful in our operations especially when it comes to account; when it comes to returns; the issues about money because we hold clients account so NAICOM needs to be very much aware of how those funds managed.

“The provision in the Guideline include code of behavior and the returns we have to make at every point in time and the way audited financial accounts will have to be presented in according with the International Financial Reporting Standard (IFRS 17) Guidelines,’ Ezeibe further explained.

Earlier speaking on the topic, Leadership and Resourcefulness, the Deputy President, NCRIB, Mr. Babatunde Oguntade highlighted the qualities of a good leader and why leaders must be resourceful.

Oguntade who defined leadership as the art of influencing individuals or group of persons to achieve a particular objective as required, stated that leadership is something that people must be willing to do enthusiastically, not grudgingly.

“A good leader must have vision, and a leader must be focused. A Leader is someone who has the ability to persuade and influence the behavior of the group members to carry out their responsibilities enthusiastically for attainment of common goal. A leader must have a quality of guidance, inspiration, persuasion, direction, motivation, communication, creativity etc.”

Oguntade who is also the Managing Director/CEO, Lectern Insurance Brokers Ltd, described leadership as a personal attribute that in most cases innate, inbuilt, noting that a successful leader is someone whose followers accept his guidance.

“Undoubtedly, a leader may be political leaders, spiritual leader, a person elected by team members or a person who has knowledge and wisdom and a willingness to lead. Leadership is choice and not a responsibility.

“Only a prosperous leader will be able to inspire his disciples. Prosperity is part of leadership. If you look unkempt, if you are not prospering in wisdom and technical knowledge, you cannot aspire to lead. Leadership is influence; leadership is courage; leadership is directional and leadership is functional.

Resourcefulness, he said, “is building the little that you have to achieve much more and to create further opportunities. Resourcefulness is a creative ability to find efficient and innovative way to overcome challenges; being resourceful also involves optimizing your resources to make something new or better. It is ability to adapt and solve problem creatively and this might increase your chances of leading or being hired. You can improve your resourcefulness by being receptive- learning from others.”

Earlier in his welcome address, the NCRIB LAC Chairman, Mr. Rotimi Olukorede, enjoined the members to comply with the NAICOM Guidelines in order to avoid spending money on infractions that may occur as a result of failure to comply.

He thanked the management of Staco Insurance Plc led by Mr. Wale Banmore for sponsoring the event, adding that”We know you are really back. This is an opportunity for you to reach out to members that you are back, tell them exactly what is going on and what you intend to do in the future.”

Addressing the audience, the President, NCRIB, Bar. Rotimi Edu, charged the broker to see the challenges they are facing as part of their operations and the price they must pay.

“You know when you are growing, the more you grow, the more challenges come. Although I don’t see as a negative thing that we are facing some challenges both from the industry and the regulator, but it behooves on us to ensure that these challenges are handled with immediate effect with automatic alacrity and in doing that we need your cooperation at all level.

“We have challenges of dearth of products in the market and there are so many opportunities for us to create new products. We supposed not be running after the so called ‘big account’ and I still look at it: why are we running after this account? I wonder why we break our necks, when we can create new products for our clients; when we can create new products for a group of people to solve this aspect of the industry’s problem.

“We Brokers can also think out of the box and go ahead and design some of these products to make an inroad into the market/

The Managing Director/CEO, Staco Insurance Plc, sponsors of the event told brokers that Staco is back, adding that the new management of the company is doing everything to ensure that all outstanding genuine claims are settled and called for the support of the Brokers for this to be actualized.