Nigerian Insurance Sector Grows 20.1% Higher Than GDP’s 3.5% in Q2 2022

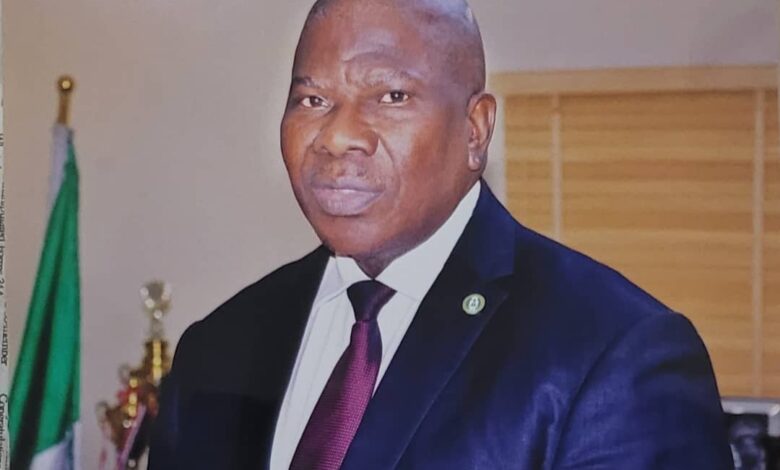

Mr. Olorundare Sunday Thomas, Commissioner For Insurance/CEO, NAICOM

The market data reveals that the industry grew 20.1% higher than the national real Gross Domestic Product (GDP) of 3.5% during the same period. This indicates the industry’s impressive performance given the recent trajectory, National Insurance Commission (NAICOM) has said.

According to the data released yesterday by NAICOM, proportional participation of each class of business is provided for in the report suggesting the continued improvement of Life Insurance business as driven by its component of the Individual Life.

The Non-Life segment as revealed in the figures maintained its primacy at 59.3% of the total premium generated. Insights in the segment show Oil & Gas was the leading driver at 32.5% with fire coming a distant second at 20.7%. Motor Insurance stood at 14.8% while Marine & Aviation, General Accident and Miscellaneous reported a share of 12.3%, 10.9% and 8.9% in this order.

“Life business on the other hand recorded 40.6% of the insurance market production as its share contribution, gradually closes up. The share of Annuity in the Life Insurance business logged at about Twenty-Five per cent (24.7%) while Individual Life held a major driver position at 41.8% of the premium generated during the period.

“On Operational confidence remained high in spite of economic challenges in the financial system and the economy at large, as demonstrated by the relevant retention positions in the sector. The Life business retention for the period was 93% while non-life recorded a ratio of 55% as the industry average stood at about seventy-One (70.5%) per cent. The retention in the non-life despite reporting an above-average level, relative to its prior position (59.4%) in the corresponding period of the preceding year, would require a focused attention for improvement as it declined by over four points representing eight per cent, year on year.

“Performance by various classes in the non-life segment of the market as revealed that all classes stood at an above average position except for the Oil & Gas business which was held a retention of forty (40.1%) per cent. That points a decline in the Oil & Gas retention capacity in the market compared to the same period in 2021 when it recorded about forty-Two (42.3%) per cent in retention proportions,” the data explained.