NAICOM, NCDMB Release Guidelines On Submission Of Insurance Programme In Oil & Gas Industry

The National Insurance Commission (NAICOM) in partnership with the Nigerian Content Development and Monitoring Board (NCDMB) has jointly released the guidelines on the submission of insurance programme by operators, project promoters, alliance partners, and Nigerian indigenous companies in the Nigerian oil and gas industry.

This is in compliance with Sections 49 and 50 of the Nigerian Oil and Gas Industry Content Development (NOGICD) Act 2010 in relation to insurance transactions.

The guidelines for the oil & gas insurance business was issued in 2010 which stipulate the roles and responsibilities of insurance institutions in ensuring compliance with local content law.

This was done with the primary consideration of ensuring that available In-Country Insurance Capacity is fully filled before any foreign consideration.

The overall aim of the guideline is the development of indigenous content through increased indigenous participation which was applauded by the entire insurance industry as it greatly complemented NAICOM roles and responsibilities in performing its regulatory and supervisory oversight function.

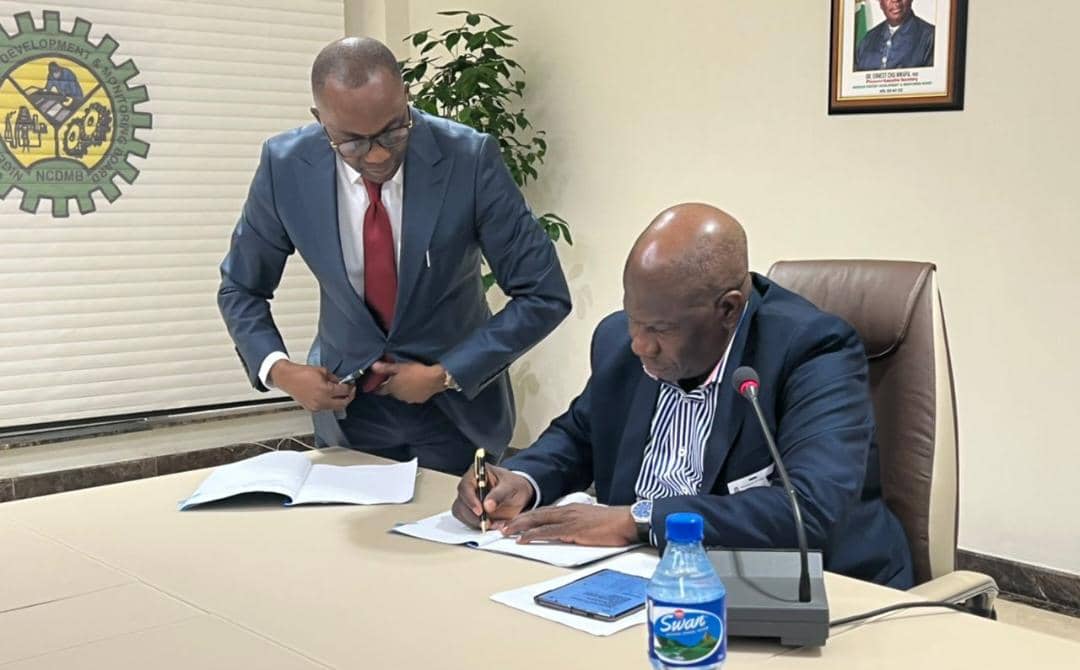

Speaking at the official signing and presentation of the joint guidelines by NAICOM and NCDMB today, the Commissioner for Insurance and Chief Executive Officer of the NAICOM, Olorundare Sunday Thomas, said the NOGICD Act was enacted following the peculiarity of the Oil and Gas industry, which facilitated the collaboration between the NCDMB and NAICOM leading to the proactive considerations of the specific provisions of the NOGICD Act relating to the Insurance Industry.

In a similar vein, Thomas explained that Sections 49 and 50 of the NOGICD Act specifically relate to Insurance & Reinsurance and approval for offshore Insurance respectively with recommended minimum levels of Nigerian Content measured by percentage spend.

He said “the synergy between NAICOM and NCDMB necessitated a veritable platform for inter-agency collaboration in order to give effect to the requirements of Section 49 and 50 of the NOGICD Act 2010 by providing guidance to Operators in the Oil and Gas necessary for satisfying the provisions of the law in relation to insurance transactions.

“The joint Guidelines which are today issued with the objectives of enforcing and strengthening compliance with the provisions of the referenced sections of the NOGICD Act and relevant provisions of the Insurance Act with respect to companies carrying on insurance business in the Nigerian oil and gas industry is to also enable the Board monitor utilization of in-country insurance capacity.”

“I, therefore, implore all operators, project promoters, alliance partners and Nigerian indigenous companies engaged in any form of business, operations or contract in the Nigerian oil and gas industry to note that the sighted relevant laws have demanded our adherence and continued compliance, hence the issuance of this Guidelines.

Thomas who expressed optimism about the realization of the benefits of increased local content of increased retention, and growth in an in-country technical capacity, stated that it will also lead to job creation and employment generation, increased penetration and GDP growth, and human capacity development, and many others.

He said Whilst noting the need to secure domestic supply chains through strong backward domestic integration which has the potency of protecting economies from imported contagion of both a health and economic variety, they are also mindful of the capacity gap of the Supply-side.

He said NAICOM is committed to creating an enabling environment that will consistently enhance the increased capacity of the Insurance Institutions both financially and technically.

In his speech, the Executive Secretary, NCDMB, Engr Simbi Kesiye Wabote, said the release of the Guidelines addresses loopholes that have been identified by the Board in implementing the provisions of the NOGICD Act, particularly sections 49 and 50.

He noted that the combined provisions of sections 49 and 50 require all operators engaged in any form of activity or project in the Oil and Gas industry to ‘’insure all insurable risks related to its oil and gas business…with an insurance company, through an insurance broker registered in Nigeria.’’

Wabote said the Act provides that where an operator seeks to place an insurable risk offshore, written approval of NAICOM must first be sought and obtained.

The essence of the above provisions of the NOGICD Act, he said, was to ensure the full utilization of available in-country capacity in the Insurance sector before seeking offshore insurance services to support retention of capital in-country and build the capacity of Nigerian insurance companies in the oil and gas industry.

He expressed optimism that “the implementation of this Insurance Guidelines will further strengthen the Board’s local content drive by ensuring that a greater portion of the spend in the Insurance industry as it relates to oil and gas activities in Nigeria is retained in-country.”

Wabote said the implementation of the guideline “will lead to more value addition and usage of Nigerian insurance firms and insurance brokers registered in Nigeria.”