Govts, Regulators, Business Operators Across Africa Urged To Evolve Risk Management Framework

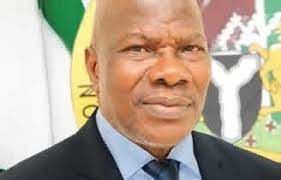

Sunday Thomas

Governments across Africa; regulators and business operators have been urged to collaborate and evolve risk management framework that suits their respective environment.

The call was made by experts who spoke on Thursday at a conference on sustainable insurance in Lagos, organised by the Financial Sector Deepening Africa (FSD Africa), UK Aid and the United Nations Environmental Program.

While speaking at the event, Group Head, Underwriting and Claims, Continental Reinsurance, Cassim Hansa, noted that risk management framework would help nations across Africa identify their risks and evolve effective means to mitigate them.

In his contribution, Chief Executive Officer, African Risk Capacity, Lesley Ndiovu, urged Africans to leverage United Nation’s Sustainable Development Goals (UN SDGs) and development risk management framework the suits their environment.

According to the Executive Director, General Business, Leadway Assurance Limited, Adetola Adegbayi, nations across Africa need sustainable risk management framework, adding that insurance operators need to work with the government to develop the framework.

She called for harmonisation of all policies on risk management to develop a single framework that suits all parties.

The Commissioner for Insurance Sunday Thomas, said the conference was put together to explore ways that insurance can play a significant role in helping African countries achieve the United Nation’s Sustainable Development Goals (UN SDGs) in terms of economic growth, social inclusion, and environmental protection and ensure sustainable development in the African insurance sector.

According to him, it seemed the role of insurance has been somewhat relegated within the context of the SDGs, stressing that this is because the current indicators largely do not capture specific insurance related metrics.

He noted that to be able to better assess the role of insurance and motivate the industry to contribute more to the SDGs, more consistent and disaggregated data collection is recommended.

“It is, however, an acknowledged fact that the insurance industry performs a very critical role in promoting economic, social and environmental sustainability and can help countries achieve the UN SDGs.

“The insurance industry helps protect society through risk prevention, risk reduction and risk sharing.

“The industry therefore plays an important role in nine of the Sustainable Development Goals (SDGs) namely:No poverty; reduced inequalities; zero hunger; good health and well-being; gender equality; decent work and economic growth; industry innovation and infrastructure; climate change, and

partnerships for goals,” he said.

He submitted that in addition, the insurance industry also plays an indirect and supporting role in five of the SDGs, namely:

Quality education; industry; innovation and infrastructure; reduced inequalities, and

partnerships for goals and sustainable cities and communities.

Thomas noted that the insurance sector holds the potential for enhancing sustainable development with the 2030 Agenda.

He said Environmental, Social and Governance (ESG) issues constitute a shared risk to insurers, businesses, governments and society.

Some ESG issues such as, climate change, pollution and eco-system degradation, have various ramifications, he said, adding that some of these issues are now considered as likely to be financially material to the success of organisations. There is therefore the compelling need for innovation and collaboration, he posited.

“The four Principles for Sustainable Insurance formalize the commitment of the signatories to ensuring decision-making along ESG criteria; raising awareness with clients and partners on ESG criteria; collaboration with governments and regulators to promote action on ESG criteria; and accountability and transparency of progress in ESG implementation.

“The corresponding list of possible actions provide a common anchor and framework for the insurance industry to manage ESG issues.

“This is expected to enhance the industry’s contribution to building resilient, inclusive and sustainable communities and economies,” he said.

On the regulatory side, he maintained that the current environment is increasingly becoming complex, adding that this has heightened the need to ensure effective supervision as well as resolve broader policy challenges such as inclusive economic development, sustainability, climate risk and digitalisation. Insurance regulators, therefore, have a vital role to play in sustainable economic development.

He said through regulatory and policy initiatives, regulators can guarantee that their insurance jurisdictions offer the essential range and variety of products and services that support the SDGs.

He submitted that Supervisors can also act as convenners of key stakeholders to building partnerships to coordinate insurance solutions, especially when faced with multifaceted risks such as climate change and pandemic risk.

Source: Inspenonline