Ensure Insurance To Deepen Insurance via Bancassurance, micro insurance

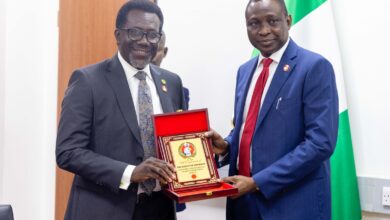

L-R: Non Executive Director, Ensure Insurance Plc, Ayodele Akande; Regional Chief financial Officer of Allianz Africa, Anuj Agarwal; MD/ CEO, Ensure Insurance Plc, Sunkanmi Adekeye; Regional Chief Executive Officer (CEO) of Allianz Africa, Coenraad Vrolijk; Executive Director/ Chief Responsibility Officer of Ensure Insurance Plc, Owolabi Salami; Regional Head of Mergers, Acquisitions and Transformation Africa-Allianz, Adeola Adewumi – Zer and Non-executive Director of Ensure Insurance Plc, Dickie Ulu at the event.

Allianz Group, one of the worlds’s leading insurers and asset managers, owners of Ensure Insurance Plc said it plans to leverage on its bancassurance partnership with Union Bank Plc to deepen insurance penetration in Nigeria.

Executive Director of the company, Owolabi Salami, who disclosed this during a press conference in Lagos recently said with over 60 branch network of the bank across Nigeria and Ensure’s regional offices in Abuja, Port Harcourt and Ibadan, they will be able to reach out and sell insurance to more Nigerians both in the urban and rural areas of the country.

He said the company will develop product that will not be limited to the upper and middle class alone but to the lower level also even as he assured that the products will be affordable and will speak to the needs of the insuring public.

He further disclosed that the company will focus on retail and corporate segment of the market to deepen insurance awareness and penetration.

On its staff strength, he said” We have a strong management team comprises of individuals with divest background. The diversity has created a lot of value to our ecosystem. We have a dynamic workforce with over 250 retail executives and full time staff strength of about 140.”

He reaffirmed that the company will provide simple, accessible and relevant insurance solution to Nigerians, while adding that they pride themselves as insurer of choice in the fast growing market in Nigeria.

Speaking further, Coenraad Vrolijk, Regional CEO Africa of Allianz, said that the group is concern about the insurance market in Nigeria and believe that the market will improve with time.

He noted that Allianz have been able to grow the local market in Ivory Coast, Senegal, Cameroon and Ghana with the help of people oriented products that are as low as N400 to N500, adding that such products can also be introduced to the Nigerian Market and be accessed through mobile phones.

He added that Allianz Group views Nigeria as a high-potential market in Africa with a strong regulatory environment and promising demographics, adding that the consummation of the acquisition will be highly beneficial to their business.

“We are pleased to enter this fast-growing market through the acquisition of a solid financial player with strong local expertise. This new step of development will allow us to leverage the strength of the Allianz Group and the expertise of the Nigerian team to provide high quality products and services to Nigerian customers in both personal and commercial lines.”

“We had clearly identified Nigeria as a high-potential market in Africa with a strong regulatory environment and interesting demographics. We are delighted to penetrate this fast-growing market through the acquisition of a solid financial player with a strong local expertise. Coupled with Allianz’s underwriting capacity and service delivery, the combined group will be able to provide the highest quality of products and services to Nigerian customers in both personal and commercial lines. We trust that our combined group will help support the Nigerian Economy and grow the local insurance market,” said Coenraad Vrolijk, Regional Chief Executive Officer (CEO) of Allianz Africa.

“The consummation of this acquisition will be highly beneficial to our business and improve our service platform to our valued clients. We are excited to harness the depth of technical competence that Allianz has acquired over the years of experience garnered through serving clients in various sectors. We are confident that this will position us for leadership in the local operating environment, “ Owolabi Salami of Ensure Insurance Plc added

Allianz had in 2017 acquired 99.03 percent of Nigeria’s Ensure Insurance Plc from its core shareholder Greenoaks Global Holdings Ltd. (GGH). Ensure Insurance Plc offers life and non-life insurance services. In 2017 Ensure generated N7.7billion or 18.2 million euros in gross premiums written in 2017 and its revenue appreciated by 83 percent full year 2017. Ensure will operate in Nigeria as Ensure – a company of Allianz.